Home Sales Surge in July for Kitchener Waterloo and Cambridge

Hope you enjoyed a wonderful long weekend and the beautiful summer weather we have been having.

It was another crazy month for home prices here in Waterloo Region. Competition stays very high for buyers looking to lock down a house in July. With the rules around covid relaxing and more people getting out with Phase 3 opening the demand for homes has increased for sure.

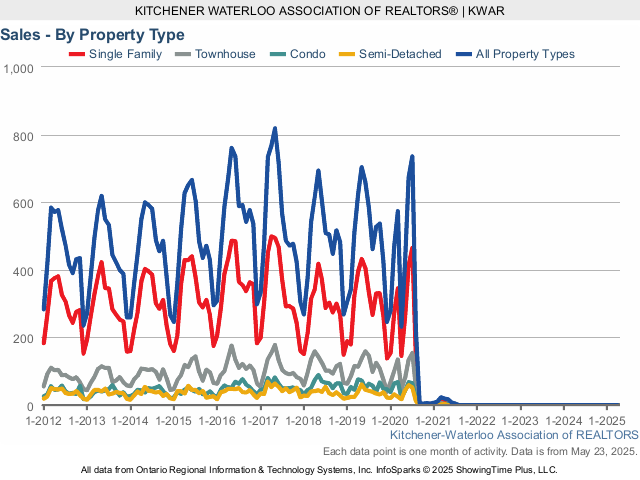

There were 734 residential homes sold in July, an increase of 25.7 per cent compared to the same month last year, and well above the previous ten-year average for July of 531.

Total residential sales in July included 464 detached homes (up 39.3 per cent from July 2019), and 65 condominium apartments (up 3.2 per cent). Sales also included 153 townhouses (up 4.8 per cent) and 52 semi-detached homes (up 23.8 per cent).

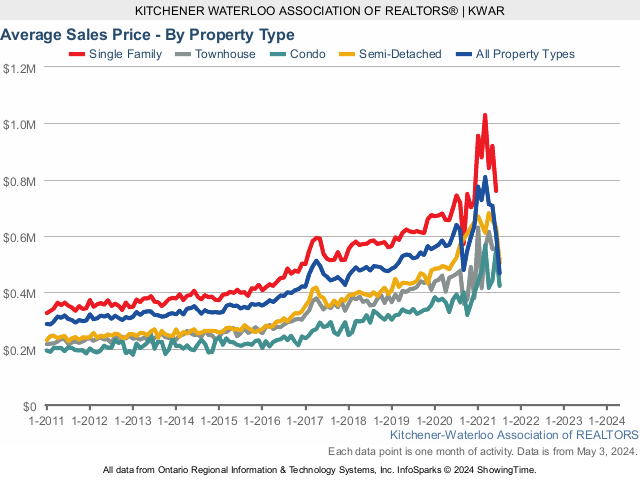

The average sale price of all residential properties sold in July increased 22.8 per cent to $639,814 compared to the same month last year, while detached homes sold for an average price of $745,149 an increase of 21.4 per cent. During this same period, the average sale price for an apartment-style condominium was $392,770 for an increase of 15.2 per cent. Townhomes and semis sold for an average of $465,756 (up 12.8 per cent) and $522,872 (up 20.4 per cent) respectively.

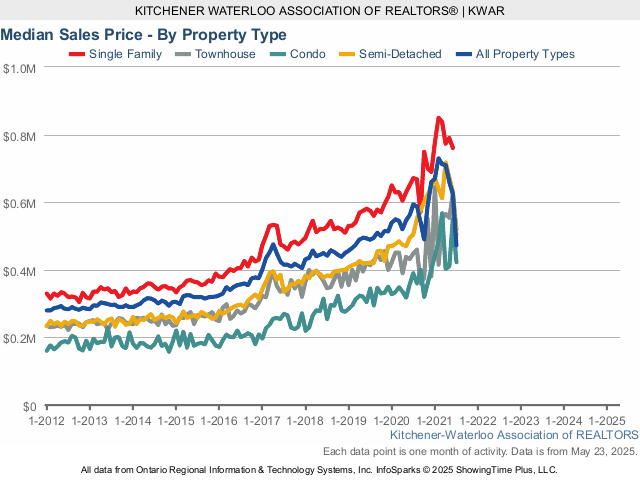

The median price of all residential properties sold in July increased 21.7 per cent to $595,000 and the median price of a detached home during the same period increased 17.4 per cent to $675,000.

With mortgage rates near all time lows homebuyers remain very confident about owning a home in Waterloo Region and I expect this to contunie going into the fall.

There were 888 new listings added, an increase of 4.3 per cent compared to July of last year, and 15.5 per cent more than the previous ten-year average for July.

The total number of homes available for sale in active status at the end of July was 592, a decrease of 32.6 per cent compared to July of last year.

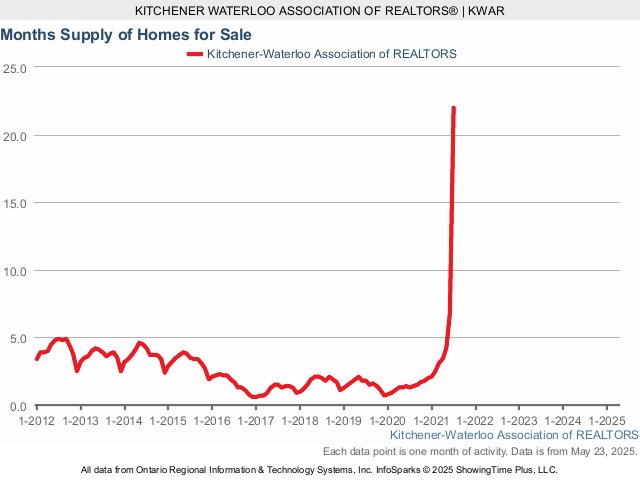

The number of Months Supply (also known as absorption rate) continues to be very low at just 1.3 months for the month of July, 27.8 per cent below the same period last year. The previous ten-year average supply of homes for July was 3.1 months, and in the past 5 years, the average supply for July was 2.1 months.

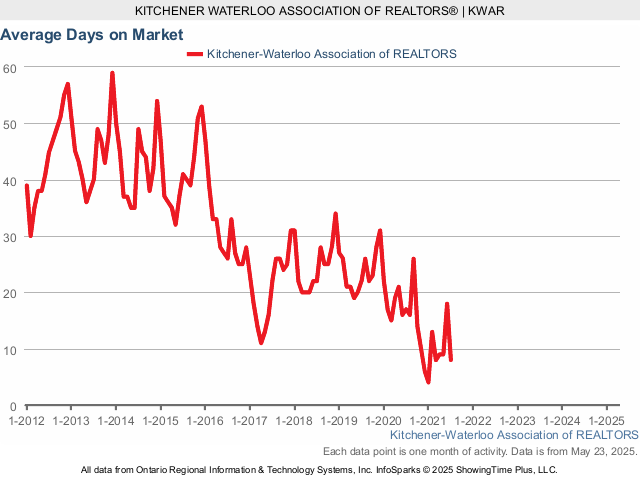

The average days to sell in July was 17 days, compared to 22 days in July 2019.

Historical Sales By Property Type

Months Supply of Homes for Sale

Historical Median Sales Price – By Property Type

Historical Average Sales Price – By Property Type

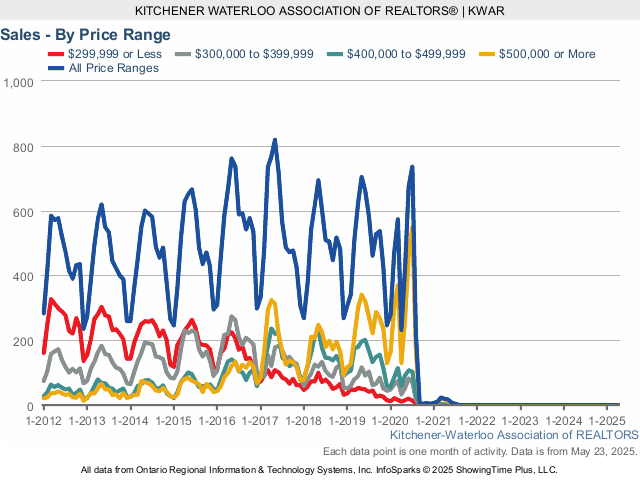

Historical Sales – By Price Range

If you are thinking of buying or selling in the coming months or have any questions at all, give me a call, text at 519-497-4646 or shoot me an email to kevinbaker@kwhometeam.ca Stay healthy and stay safe!

Have a great weekend!

Kevin

August 6, 2020 | Categories: Buyers, Local Kitchener Waterloo, Random thoughts, Sellers, Uncategorized | Tags: 2019, activa, apple butter, appraisal, arrow, assessment, August, backyard, Bank of Canada, banking practices, basketball, bauer, bee's, beechwood, being social, bird droppings, board of education, breslau, brokerage, business online, cambridge, canadian, carbon monoxide, chicopee, cibc, city center, city centre, closing costs, closing paperwork, cmhc, colonial acres, commission, condo, condo buying, condo documents, condo for sale, condo market, condo prices, condo sales, condo values, condos, corona, crafts, district, down payment, downsizing, downtown, downtown kitchener, due diligence, eastbridge, elmira, energy audit, exclusive, facebook, fall, fall market, fear, february, festival, first time home buyer, for sale, forest heights, forest hill, free home evaluation, full time realtor, fun fact, fun stuff to do., garment, gas furnace, goal setting, government, green homes, guelph, harmonized sales tax, home buying, Home energy audit, home for sale, home inspection, home maintenance, home ownership, home price, home prices, home sales, home selling, home staging, home value, home values, homes, homes for sale, hornets, house, house for sale, house price, house prices, house sales, house value, houses for sale, housing update, hst, hydro, interest rate, investment, january, june, kaufman, kevin baker, kitchen cabinets, kitchener, Kitchener waterloo, kitchner, land transfer tax, landlord, laurelwood, laurentian, lawyer, lawyers, lexington, licensing, listing your home, loft, loft for sale, loft style, lofts, mansion, march, march update, market update, market value, marketing, may, midtown, midtown lofts, mls, mortage rates, mortgage, Mortgage News, Mortgage Rates, mortgage rules, mortgages, multiple listing service, multiple offer, networking, new construction, newspaper, november update, older homes, Olympic gold, online advertising, ontario, open house, open houses, opportunity, options for homes, painting, pioneer park, price, prices, pricing your home, Prime rate, private, privately, rates, rbc, real estate, real estate agent, real estate investing, real estate lawyer, real estate lawyers, real estate market, real estate team, real estate update, real estate values, realtor, realty, red, region, Remax, remax agent, rental, royal bank, sale, sale price, sales, sales agent, sales rep, sales representative, saving money, selling your home, september, single detached, special assessment, spring market, stanley park, stanleypark, summer, summer market, Survivor, tanglewood, tax credit, td canada trust, teamwork, tech savvy, to do list, toronto, townhome, townhouse, transit, twin city, twitter, union station, uptown waterloo, virus, waterloo, waterloo ontario, waterloo region, wellesley, westvale, winter market, winter sales | Leave a comment

Home Sales in Kitchener Waterloo come in Like a lion and out like a Lamb in March

Hope you have been staying safe during this unique time in all our lives. Rest assured Yogi and I are doing everthing we can to prevent the spread by staying home as much as posssible and limiting client interactions to phone calls, facetime, zoom meetings, etc. We are both here to help if you and your family need to make a move and we have the tools and systems in place for both buyers and sellers for proper marketing of our listings, getting buyers to view the properties, as well as ourselves to keep everyone safe.

I thought you would like an update on what is happening out there in the Waterloo Region Real Estate Market, so here are the stats for March.

There were 577 residential homes sold in March, an increase of 13.1 per cent compared to the same month last year, and 0.2 per cent below the previous 5-year average.

During the first quarter of 2020, there were 1,327 home sales, 14.6 per cent above last year’s result for the same period and 4 per cent above the previous 5-year average.

Total residential sales in March included 348 detached homes (up 7.1 per cent), and 68 condominium apartments (up 5.1 per cent). Sales also included 136 townhouses (up 17.2 per cent) and 25 semi-detached homes (up 4.2 per cent).

The average sale price of all residential properties sold in March increased 15.3 per cent to $583,752 compared to the same month last year, while detached homes sold for an average price of $679,728 an increase of 15.9 per cent. During this same period, the average sale price for an apartment-style condominium was $378,443 for an increase of 17.9 per cent. Townhomes and semis sold for an average of $457,547 (up 23 per cent) and $492,752 (up 17.4 per cent) respectively.

The median price of all residential properties sold in March increased 14.6 per cent to $544,500 and the median price of a detached home during the same period increased 16.2 per cent to $628,500.

Now of course is this not business as usual for us as Realtors or our clients. As people everywhere follow instructions to only leave their homes for essential reasons, this is impacting the number of showings, and how properties are shown.

There were a higher than average number of homes listed during the Month of March. There were 864 new listings added to the MLS® System in KW and area last month, an increase of 7.6 per cent compared to March of 2019, and the greatest number since 2015. The number of new residential listings was also 3.7 per cent higher than the previous ten-year average for March.

The total number of homes available for sale in active status at the end of March was 535, a decrease of 35.9 per cent compared to March of last year.

Despite the much-needed addition of new inventory coming to the market, the number of Months Supply (also known as absorption rate) continues to be very low at just 1.1 months for the month of March, 35.3 per cent below the same period last year. The previous ten-year average supply of homes for March was 2.73 months, and in the past 5 years, the average supply for March was 1.94 months.

There were also 51 listings last month that were suspended, which means the listing is temporarily “off-market,” and there can be no marketing, showings or offers during this period.

Trying to sell your home while in quarantine, self-isolating or worse yet, while someone in the house is sick, is not going to be in anyone’s best interest. We know many people are postponing their plans to list their home for the time being. As I mentioned earlier, if you find yourself in a situation where you need to buy or sell then rest assured Yogi and I are ready to help and have the tools in place to market, show and sell your home. The number of sales is keeping pace with the new listing inventory so there are still buyers out there looking to buy. We are doing everything we can to keep everyone safe during this time.

Historical Sales By Property Type

Months Supply of Homes for Sale

Historical Median Sales Price – By Property Type

Historical Average Sales Price – By Property Type

Historical Sales – By Price Range

If you have any questions or concerns at all, give me a call or text at 519-497-4646 or shoot me an email to kevinbaker@kwhometeam.ca . Stay healty and stay safe!

Have a great weekend

Kevin

April 4, 2020 | Categories: Buyers, Local Kitchener Waterloo, Random thoughts, Sellers, Uncategorized | Tags: 1 victoria, 144 park, 2019, activa, advertising, apple butter, appraisal, april update, arrow, arrow lofts, assessment, August, backyard, Bank of Canada, banking practices, basketball, bauer, bauer lofts, bee's, beechwood, being social, bird droppings, blogging, board of education, brokerage, business online, cambridge, canadian, canadian mortgage housing corporation, carbon monoxide, charlie west, chicopee, cibc, city center, city centre, closing costs, closing paperwork, cmhc, colonial acres, commission, condo, condo buying, condo documents, condo for sale, condo in kitchener, condo market, condo price, condo prices, condo sales, condo update, condo values, condos, condos in kitchener, corona, covid, covid-19, crafts, deck and pool, district, down payment, downsizing, downtown, downtown kitchener, due diligence, east ward, eastbridge, elmira, energy audit, energy rebate, exclusive, facebook, fall, fall market, fear, february, federal home buyer program, festival, first time home buyer, for sale, forest heights, forest hill, Frederick Art Walk, free home evaluation, full time realtor, fun fact, fun stuff to do., furnace efficiency, garment, gas furnace, goal setting, government, green homes, guelph, harmonized sales tax, HBTC, hoems for sale, home, home buying, Home energy audit, home for sale, home inspection, home maintenance, home ownership, home price, home prices, home sales, home selling, home staging, home upkeep, home value, home values, homes, homes for sale, hornets, house, house for sale, house price, house prices, house sales, house value, houses for sale, housing update, hst, hydro, interest rate, inventory levels, investment, january, june, june update, kaufman, kaufman lofts, kevin baker, kitchen cabinets, kitchener, Kitchener waterloo, kitchner, kwhometeam, kwrealestatelife, land transfer tax, landlord, landlord license bylaw, laurelwood, laurentian, lawyer, lawyer information, lawyers, lexington, Licensed lodging house, licensing, licensing bylaw, listing your home, loft, loft prices, loft style, lofts, lofts in kitchener, mansion, march, march update, market update, market value, marketing, may, mls, mortage brokers, mortage rates, mortgage, Mortgage News, Mortgage Rates, mortgages, multiple listing service, multiple offer, National Home Show, networking, new condo construction, new construction, newspaper, november update, older homes, Olympic gold, online advertising, ontario, open house, open houses, opportunity, options for homes, painting, pioneer park, price, prices, pricing your home, Prime rate, private, privately, rates, rbc, real estate, real estate agent, real estate investing, real estate lawyer, real estate lawyers, real estate market, real estate team, real estate update, real estate values, realtor, realty, red, red condos, region, Remax, remax agent, remax twin city, rental, royal bank, rrsp contribuitions, sale, sale price, sales, sales agent, sales rep, sales representative, saving money, seagrams, seagrams loft, seagrams lofts, selling home in winter, selling your home, september, september update, single detached, special assessment, spring market, stanley park, stanleypark, status certificate, summer, summer market, Survivor, tanglewood, tax credit, td canada trust, teamwork, tech savvy, to do list, toronto, townhome, townhouse, transit, twin city, Twin City Realty, twitter, union station, university downs, uptown waterloo, virus, waterloo, waterloo bylaw, waterloo district school board, waterloo ontario, waterloo region, waterloo region school board, wellesley, westvale, winter market, winter sales | Leave a comment

The Strong Housing Market Continues here in Kitchener Waterloo

It was another healthy month here in Waterloo region for home sales with prices continuing to rise and many Buyers being left to wonder if they will ever be able to finally buy that elusive home. The Multiple offers continue to show up everywhere. Demand is certainly far outweighing supply at this point. A strong appetite for home ownership combined with slimmer inventory levels means it’s a sellers market and its here to stay for the foreseeable future.

Here are some stats:

Last month a total of 577 residential properties sold in KitchenerWaterloo and area though the Multiple Listing System (MLS®), an increase of 24.4 percent compared to October of 2015, and an all-time high for the month. October’s sales included 359 single detached homes (up 18.9% compared to October 2015) and 130 condominium type units (up 28.7%) which include any property regardless of style. Sales also included 41 semi-detached homes (down 105 percent) and 39 freehold townhouses (up 2.6 percent).

Record breaking sales are also being tallied on a year-to-date basis with 5,818 residential transactions compared to 4,920 during the same period in 2015, representing an increase of 18.3 percent. Conversely, inventory levels are low with only 729 active residential listings on the market to the end of October, a decline of 11 percent compared to the previous month, and 53.9 percent below the same period last year.

The average price of all residential properties sold in October was $408,067 a 12.7 percent increase over 2015. Detached homes sold for an average price of $478,685, an increase of 14.3 percent compared to October 2015. During this same period, the average sale price for an apartment style condominium was $225,221, an increase of 5.6 percent. Town homes and semis sold for an average of $307,294 (up 17.6 percent) and $329,966 (up 23.9 percent) respectively.

The median price of all residential properties sold in October increased 17.2 percent to $375,000, and the median price of a detached home during the same period increased 16.8 percent to $438,000.

New measures by the federal government which introduced a mortgage rate “stress test” on all new insured mortgages took effect on October 17, 2016. While the overall impact of these changes is yet to be fully understood, It is likely that some first-time homebuyers rushed to purchase prior to the stress test coming into effect.

If you have been thinking of selling or have any questions on things give me a call and we can sit down and discuss some different options and strategies for your family to be competitive in the new housing market that we are experiencing.

You can contact me at 519-497-4646 or email direct to kevinbaker@kwhometeam.ca

Thanks and enjoy the fall weather.

Kevin

November 7, 2016 | Categories: Buyers, Local Kitchener Waterloo, Random thoughts, Sellers, Uncategorized | Tags: Bank of Canada, condo, condo buying, condo documents, condo in kitchener, condos in kitchener, eastbridge, first time home buyer, full time realtor, home buying, home value, inventory levels, kevin baker, Kitchener waterloo, lofts in kitchener, market update, Mortgage News, Mortgage Rates, real estate, real estate investing, Remax, sales rep, selling your home, twin city, waterloo, waterloo ontario, waterloo region school board | Leave a comment

Another Hot Month for Kitchener Waterloo Home Sales

Hi there and hope you had a fantastic summer!

The housing market here in Kitchener Waterloo is as hot as the weather has been this past summer! There were a total of 598 home sales in KitchenerWaterloo and area though the Multiple Listing System (MLS® System) of the Kitchener-Waterloo Association of REALTORS® (KWAR) in August. This represents a 26.4% increase in sales compared to August of 2015. It also ranks as the most active August on record and 37.6% above the 5-year average for the month. That is simply amazing.

Year-to-date sales also climbed to new heights with 4,703 residential sales so far in 2016. Again, this is the highest on record for this period and 23.4% above the 5-year average.

We are still experiencing a lower than normal listing number with active listings almost half of what they were last year at this time. Active listings through the MLS® System to the end of August sat at 863, which is 46.6% lower compared to same period last year’s 1,616 homes that were on the market. That means we are still experiencing a very tight market in terms of availability of homes which continues to push up home prices in the region.

August’s sales included 353 single detached homes (up 19.7% compared to August 2015) and 151 condominium type units (up 36.0%) which include any property regardless of style (ie. semis, townhomes, apartment, detached etc). Sales also included 40 Semi-detached homes (up 14.3%) and 49 freehold townhouses (up 69.0%).

The average sale price of all residential sales in August increased 15.2% to $402,000 compared to August 2015. Its clear that as a result of the strong residential activity that buyers remain confident about home values here in the region.

Single detached style homes sold for an average price of $487,050 an increase of 20.9% compared to last year. The average sale price for an apartment style condominium was $233,302, an increase of 7.9%. Townhomes and semis sold for an average of $298,148 (up 10.2%) and $299,353 (up 5.5%) respectively.

Overall. the market is extremely competitive and if you are thinking of selling your home now is a great time to take advantage of the strong home prices. If you have any questions or would like to get together for a coffee and discuss how we can help with your housing needs please give me a call or text at 519-497-4646. You can also email me at kevinbaker@kwhometeam.ca

September 8, 2016 | Categories: Buyers, Local Kitchener Waterloo, Random thoughts, Sellers, Uncategorized | Tags: assessment, Bank of Canada, condo, condo buying, condo documents, condo in kitchener, condos in kitchener, first time home buyer, full time realtor, home buying, home value, inventory levels, kitchener, Kitchener waterloo, kwrealestatelife, lofts in kitchener, market update, mls, Mortgage News, real estate, real estate investing, Remax, sales rep, selling your home, twin city, waterloo ontario, waterloo region school board, westvale | Leave a comment

Kitchener Waterloo Posts Record Number of Sales for First Half of 2016

It is another fantastic month for Real Estate here in the Waterloo Region. The Region had another record setting month with 740 properties sold in Kitchener-Waterloo and area in the month of June. This represents a 13.1% increase compared to the June of 2015, and ranks as the most active June on record. Honestly in my 15 years as a Realtor I have not seen a market like this one.

During the first half of 2016, there were 3,519 home sales, 18.0% above last year’s total for the same period and 22.8% above the 5-year year-to-date average. That would make the highest number of home sales we have ever recorded in the first half of the year.

On a monthly basis, home sales were 29.7% above the 5-year average for the month of June. As sales continue their upward trend, active residential listings continue to remain depressed in comparison to the same time last year. Currently, the number of active residential listings on the KWAR’s MLS® System to the end of June sat at 1,199, which is 33.9% lower compared to same period last year. This translates to 51.4% fewer available listings on the market today than the same time last year. That means the market needs more sellers to keep up with the high demand of buyers that are looking in the area. With some of the prices that homes have been selling for, now is a great time to get your home up on the market.

June’s sales included 485 single detached homes (up 13.6%) and 145 condominium type units (up 2.1%) which include any property regardless of style (ie. semis, townhomes, apartment, detached etc). Sales also included 46 Semi-detached homes (up 9.5%) and 54 freehold townhouses (up 42.1%).

The average sale price of all residential sales in June increased 11.2% to $390,144 compared to June 2015. With fewer listings on the market combined with an increased interest in people wanting to live in the Region, we’re seeing upward pressure on home prices.

Single detached style homes sold for an average price of $451,289 an increase of 10.7% compared to last year. The average sale price for an apartment style condominium was $232,999, an increase of 8.0%. Townhomes and semis sold for an average of $277,672 (up 14.5%) and $296,572 (up 10.6%) respectively.

If you have been tossing around the idea of selling your home, give me a call and we can sit down and look at the best options for you and your family.

Have a great July!

Kevin

July 5, 2016 | Categories: Buyers, Local Kitchener Waterloo, Sellers, Uncategorized | Tags: assessment, Bank of Canada, banking practices, condo, condo buying, condo documents, condo in kitchener, eastbridge, first time home buyer, full time realtor, home buying, home value, inventory levels, kevin baker, kitchener, Kitchener waterloo, kwhometeam, kwrealestatelife, loft, lofts, lofts in kitchener, market update, mls, Mortgage News, real estate, real estate investing, realtor, Remax, sales rep, selling your home, twin city, waterloo, waterloo ontario, waterloo region school board | Leave a comment

Waterloo Region Residential Sales Hit All Time High in May

All I have to say is WOW!!!! What an incredible month for the Kitchener Waterloo and Cambridge Real Estate Markets. The market is on fire with many homes selling over list price in multiple offer situations. The buyers seemed to be lined up out the door if you have a property under the 430k mark in certain neighborhoods of town.

Here are some of the stats from the past month. There were 752 properties sold in KW and area which represents a 19.6% increase compared to May of 2015, and a 27.7% increase compared to the 5-year average for the month of May.

This is the first time since 2007 that residential sales in May exceeded seven hundred units. Year-to-date sales for 2016 also hit an all-time high with 2,776 homes sold in the first five months of the year, 19.2% above last year’s total for the same period and 21.0% above the 5-year average.

Active listings however are down in comparison from last year. Currently, the number of active residential listings on the KWAR’s MLS® System to the end of May is at 1,283 which are 26.1% lower compared to same period last year. This translates to 35.2% fewer available listings on the market today than the same time last year.

So what does that mean? If you are thinking of selling your home now is a great time to do it. Unfortunately you may also wish to buy and that could prove challenging with the lower than usual inventory buyers often find themselves competing with other buyers, for the same property.

With steady interest rates expected into the later part of 2016 and early 2017, and steady employment growth, the region is poised to continue the demand for housing and we should see balanced market conditions return for the foreseeable future in Waterloo Region.

May’s sales included 474 single detached homes (up 15.6%) and 166 condominium type units (up 37.2%) which include any property regardless of style (ie. semis, townhomes, apartment, detached etc). Sales also included 47 Semi-detached homes (down 11.3%) and 56 freehold townhouses (up 27.3%). The average sale price of all residential sales increased 7.3% to $378,248 compared to May 2015. Single detached style homes sold for an average price of $438,708 an increase of 9.8% compared to last year. The average sale price for an apartment style condominium was $221,073, a decrease of 1.2%. Townhomes and semis sold for an average of $277,355 (up 1.1%) and $296,751 (up 10.2%) respectively.

If you have any questions on the stats or are thinking of making a move in the near future, please give me a call and we can sit down, grab a coffee and look at your options.

Have a great week!

Kevin

June 6, 2016 | Categories: Buyers, Local Kitchener Waterloo, Random thoughts, Sellers, Uncategorized | Tags: assessment, Bank of Canada, condo, condo buying, condo documents, condo in kitchener, condos in kitchener, eastbridge, first time home buyer, full time realtor, home buying, home value, inventory levels, kevin baker, Kitchener waterloo, loft, lofts in kitchener, market update, Mortgage News, real estate, real estate investing, Remax, sales rep, twin city, waterloo, waterloo ontario, waterloo region school board, westvale | Leave a comment

Home Sales Set Record here in Kitchener Waterloo for March 2016!

It was another Fantastic Month for Home Sales here in Waterloo Region with 584 properties sold in the Kitchener Waterloo area.

This represents a 16.3% increase compared to the March of 2015, and ranks as the highest March on record since 2010. That is just incredible.

During the first quarter of 2016, there were 1,350 home sales, 23.9% above last year’s total for the same period and 17.8% above the 5-year quarterly average and the highest quarter on record since 2010. On a monthly basis, home sales were 16.6% above the 5-year average for the month of March. The mild weather has brought the buyers out in droves and the spring market is well underway!

March’s sales included 383 single detached homes (up 11.2 %) and 110 condominium type units (up 26.4%) which include any property regardless of style (ie. semis, townhomes, apartment, detached etc). Sales also included 38 Semi-detached homes (down 2.6%) and 42 freehold townhouses (up 50.0%).

The average sale price of all residential sales increased 5.8% to $371,733 compared to March 2015. Single detached style homes sold for an average price of $428,495 an increase of 9.2% compared to last year. The average sale price for an apartment style condominium was $211,117, a decrease of 11.9%. Townhomes and semis sold for an average of $284,226 (up 9.7%) and $276,562 (up 0.6%) respectively.

Sales activity in the $350,000 – $399,999 range increased significantly in the month of March with 98 homes sold in that range, a 78.2% increase from the same time last year. Yes I said 78.2%!! That is clearly evident with all the multiple offers that we have been involved in over the past month.

Year-to-date residential sales in the $300,000-$399,999 remain most popular with 490 sales to date accounting for 36.3% of all residential sales. Pushing the average sales price up for the month were increased sales in the $500,000 – $749,999 range, which posted a 31.6% increase in units sold, compared to March 2015

All in all, Kitchener Waterloo is still showing that we have a vibrant economy and home values are continuing to show strength.

If you have any questions on the information above or are interested in buying or selling in the coming months feel free to give me a call at 519-497-4646 or email to kevinbaker@kwhometeam.ca

I am happy to help.

Have a wonderful April!

Kevin

April 6, 2016 | Categories: Buyers, Sellers, Uncategorized | Tags: assessment, Bank of Canada, condo, condo buying, condo in kitchener, condos in kitchener, eastbridge, first time home buyer, full time realtor, home buying, home value, inventory levels, kevin baker, Kitchener waterloo, kwhometeam, loft, lofts in kitchener, march, market update, market value, Mortgage News, real estate, real estate investing, Remax, sales rep, waterloo ontario, waterloo region school board | Leave a comment

Kitchener Waterloo Home Sales Take a Leap in February! – Market update

All I have to say is WOW, what a month! The housing market is on fire with multiple offers and low inventory it seems that the spring market has started. Here are some of the highlights from the past month.

Residential sales were up 28.2% compared to the same month last year with 452 homes being sold. That is 18.6 percent above the 5 year average for the month. Those sales included 280 single detached homes which is up 40.7% over last February, 33 semi- detached(down 17.5%), 31 townhomes (up 6.9%) and 103 Condo units (up 25.6%). That makes this past February the most active February since 2008! With interest rates still holding steady, Waterloo region remains an attractive place to live and invest.

Single detached homes sold for an average price of $419,480 which is an increase of 7.7% compared to last year. The average sale price for a Condo unit was $242,272 up 8.3% while townhomes and semis sold for an average of $328,569 (up 10.0%) and $291,770 ( up 12.0) respectively.

The average sale price of all residential sales through the KWAR’s MLS® System increased 10.3% to $361,889 compared to February 2015 with 42.0% of home sales in February occurring in the $250,000-$350,000 range. With all the cold temperatures that we experienced last year that helped contribute to a 5-year low in home sales for the month. Things have been quite a bit warmer these past few weeks in comparison, and it goes to show how much of a role weather can play when it comes to buying or selling and kicking off the spring market!

If you are thinking of buying or selling now is a great time to start the process. Give me a call at 519-497-4646 or email to kevinbaker@kwhometeam.ca and I can provide all the information you need to make the right decision.

Have a great March!

Kevin

March 3, 2016 | Categories: Buyers, Local Kitchener Waterloo, Random thoughts, Sellers | Tags: assessment, Bank of Canada, condo, condo buying, condo documents, condo in kitchener, condos in kitchener, first time home buyer, full time realtor, home value, inventory levels, kevin baker, Kitchener waterloo, loft, lofts in kitchener, market update, Mortgage News, real estate, real estate investing, realtor, Remax, sales rep, selling your home, twin city, waterloo, waterloo ontario, waterloo region school board | Leave a comment

November Kitchener Waterloo Market Update and NO to the MLTT

Realtors and Home owners here in Waterloo Region and across Ontario have spoken and the Minister of Municipal Affairs and Housing has heard our outrage. The Minister confirmed this week that the government will not give the municipalities the ability to charge the Municipal Land Transfer Tax.

This is fantastic news for everyone in the region!!!

Now that this bullet is dodged, here in Waterloo Region it was another good month of home sales with a total of 413 residential properties sold last month compared to 376 in November last year. This number included 254 single detached homes (up 10.0% from last November), 22 semi-detached (down 45%), 33 townhomes (down 15.4%) and 99 condominium units (up 37.5%).

Average prices also increased 8.2% to an average price of $412,581 for single detached homes. Condo’s were up 7.3% with an average of $225,341, while townhomes and semis sold for an average of $313,015 (up 13.8%) and $257,995 (down 1.9%) respectively. Average sale price of all residential sales through the Kitchener Waterloo MLS system increased to $350,703 up 6.7%

With 2015 drawing to a close shortly we have had another outstanding year for homes sales in Waterloo Region. CMHC is forecasting steady mortgage rates and stronger employment in the Region for 2016 and that means continued demand for housing. Comparing our prices here against our neighbors in the GTA, Waterloo Region still remains very affordable.

If you are looking to make a move in the spring and would like to have a better idea of what your home is worth click here now. Whether buying or selling give me a call and let’s sit down for a coffee and discuss how we can help make the move to a new home a smooth one for you and your family. I can be reached at 519-497-4646 or email to kevinbaker@kwhometeam.ca

Have a wonderful Holiday Season with your family!

Kevin

December 4, 2015 | Categories: Buyers, Local Kitchener Waterloo, Sellers, Uncategorized | Tags: Bank of Canada, condo, condo documents, condo in kitchener, condos in kitchener, eastbridge, facebook, first time home buyer, full time realtor, home buying, home value, inventory levels, kevin baker, Kitchener waterloo, kwhometeam, kwrealestatelife, land transfer tax, loft, lofts in kitchener, MLLT, Mortgage News, real estate, real estate investing, Remax, sales rep, selling your home, twin city, waterloo, waterloo ontario, waterloo region school board, westvale | Leave a comment

October Home Sales Ease in Kitchener Waterloo

Home sales in October showed some signs of easing in Waterloo Region with an overall decrease of 9.4%. The Multiple listing System (Mls) showed a total of 435 home sales compared to 480 during the same period in 2014.

Here is the breakdown:

Residential sales this October included 284 single detached homes (down 6.9% from last October), 20 semi-detached (down 23.1%), 37 townhomes (up 5.7%) and 92 condominium units (down 19.3%).

The great news is average prices are up again with an average price for a single detached home in October selling for an average price of $417,891 an increase of 8.9% compared to the same month last year.

The average sale price for a condominium was $242,280 an increase of 14.3%, while the average sale price of all residential sales in KW and Area increased 9.9% to $363,438 compared to October 2014.

Townhomes and semi-detached properties sold for an average of $300,724 (down 2.5%) and $265,000 (up 2.2%) respectively.

The Kitchener Waterloo housing market continues to show long term stability and strength and the shifts in average prices and month to month fluctuations are normal, along with sales easing as we approach the end of the year. Keep in mind you always need to use caution when looking at averages. The increase in detached and overall home prices are due in part to six home sales in October 2015 over $900,000 compared to zero sales in that range the previous year.

If you have any questions on any of this information or are thinking of making a move before Christmas or in the spring please give me a call. Knowing what your home potentially could be worth is the one of the first steps to making a decision on whether now is the right time to make a move.

For a Free Report on your home’s value, take a moment to email me at kevinbaker@kwhometeam.ca or call or text to 519-497-4646. I am always happy to help

Have a great week

Kevin

November 9, 2015 | Categories: Buyers, Local Kitchener Waterloo, Random thoughts, Sellers | Tags: Bank of Canada, condo, condo buying, condo documents, condo in kitchener, first time home buyer, full time realtor, home buying, home value, inventory levels, kevin baker, kitchener, Kitchener waterloo, kwhometeam, lofts in kitchener, market update, Mortgage News, real estate, real estate investing, Remax, sales rep, selling your home, twin city, waterloo, waterloo ontario, waterloo region school board, westvale | Leave a comment

Are you ready for Double Land Transfer Tax here in Kitchener Waterloo?

People of Ontario get ready. The provincial government is talking about giving each municipality the power to implement its own Land Transfer Tax in addition to the federal one that we all pay for purchasing a new property. It’s a tax realtors have never stopped fighting in Toronto since it was introduced seven years ago, and now our worst fears may be coming true.

The Ontario Real Estate Association (OREA) insisted Tuesday the governing Liberal party is going ahead with plans that will allow municipalities to follow Toronto’s lead and implement their own land transfer tax. Ontario government officials deny anything has been decided. The plans were revealed by the Toronto Sun Tuesday.

Picture this, buyers in Toronto purchasing a $1 million home get slapped with a $32,200 tax to transfer property, $15,725 of which is the city of Toronto’s portion.

We have seen an influx of people moving west of the GTA to purchase homes in the Waterloo Region, due in part to prices as well as avoiding the Double Taxation in Toronto.

I have little doubt that once the province allows the tax to proceed, municipalities will take advantage of it. Once one starts I believe they will all fall like dominoes. This means that the Ontario home buyers will pay the highest land transfer tax in North America.

When Toronto implemented the double tax, they saw lower prices equal to if not greater than the amount of the tax. The problem is that it is just not one tax, but every purchase after that as well.

So what does that mean for the Residents of Waterloo Region? If the tax does come into effect it could be a major factor in deciding between buying or waiting. The effect on prices and availability of homes could certainly be affected. With the economy here in the region still very strong and housing prices showing no signs of any significant slow down, this may not be the news that we want to hear. We will just have to wait and see what the result will be if the plan does move forward.

If you have any questions on any real estate related topic feel free to shoot me an email at kevinbaker@kwhometeam.ca or give me a call at 519-579-4110.

October 29, 2015 | Categories: Buyers, Local Kitchener Waterloo, Random thoughts, Sellers | Tags: condo, condo buying, condo in kitchener, condo value, condos in kitchener, eastbridge, first time home buyer, full time realtor, home buying, home value, homes, house for sale, house value, inventory levels, kevin baker, kitchener, land transfer tax, lofts in kitchener, ontario, real estate, real estate investing, Remax, waterloo, waterloo ontario | Leave a comment

Kitchener Waterloo Home Sales Remain Strong in August – Market Update

Its been another strong month of home sales here in the Waterloo Region. With a total of 459 sold through the Multiple Listing System (MLS®). The month of August did post a 2.1% decrease in home sales compared to the same month last year across Kitchener-Waterloo and area. However, home sales in the month of August were 9.5% percent above the 5-year average for the month.

This strong sales activity helped bring year-to-date total sales to 3,991, a 6.1% increase compared to the same time last year, and 6% above the 5-year average. Year-to-date sales were also the highest on record since 2008. There was strong residential sale activity this summer season and with recording setting year-to-date sales it’s clear that buyers remain confident about the value of homes in Kitchener-Waterloo and area.

Residential sales in August included 284 single detached homes (down 2.1% from last year), 35 semidetached (up 2.9%), 29 townhomes (down 17.1%) and 107 condominium units (down 0.9%). The average sale price of all residential sales through the KWAR’s MLS® System increased 6.6% percent last month to $347,057 compared to August 2014. Single detached homes sold for an average price of $401,533 an increase of 6.2% percent compared to last year. The average sale price for a condominium was $241,508, an increase of 7.7% percent and the average sale price for a freehold townhome was $300,546, an increase of 2.9% percent from the same time last year.

Overall these numbers show that the real estate sector here in the Kitchener Waterloo is showing no signs of slowing down and points to a long term stability and strength.

If you have any questions on any of the information provided above or would like to discuss your specific real estate needs please give us a call or email to kevinbaker@kwhometeam.ca

Have a great day!

September 9, 2015 | Categories: Buyers, Local Kitchener Waterloo, Random thoughts, Sellers, Uncategorized | Tags: Bank of Canada, condo, condo buying, condo documents, condo in kitchener, condos in kitchener, eastbridge, first time home buyer, full time realtor, home buying, home value, inventory levels, kevin baker, Kitchener waterloo, kwhometeam, lofts in kitchener, market update, Mortgage News, real estate, real estate investing, Remax, sales rep, twin city, waterloo ontario, waterloo region school board | Leave a comment

Getting Your Home Ready For Fall – Kitchener Waterloo Homes and Condos for sale.

Getting Your Home Ready For Fall

It’s that time again, the kids are heading back to school, the leaves are beginning to change, and the hockey season is finally about to begin. Here are some great tips for getting your home ready for the fall:

Home Exterior: It is recommended that you check your home siding for cracks and holes; clean all debris from your gutters. If you have a fireplace that you use regularly, it might be a good idea to have it checked as well. If you don’t want to do any of these tasks yourself, there are professional services that you can hire to do them.

Thermostat: Programmable thermostats have become more popular among home owners. Raise or lower the temperature remotely and program settings for the temperature to automatically lower during the night. A Programmable thermostat can not only increase your enjoyment of your home, it can save you money as well.

Drafts: You don’t want heat to escape during the colder months of the year. Check for drafts to ensure your home is as efficient as possible.

Organize: As the summer winds down, take some time to clean and organize your summer furniture, tools, etc. This will make your life far easier come next spring/summer. If you are already organizing in your garage, it may be a good time to do a clean or purge while you are there.

Roof: Before every fall and winter you should at least do a visual check of your roof. Has there been significant wear since last year? Look for missing, damaged, or loose shingles. If your roof is flat, it is recommended you remove debris from your roof.

Landscape: Check trees to ensure there are no damaged limbs that could fall on your home or power lines during a strong wind or snow storm. Trim back shrubs, flowers, and bushes in your yard. If you plan on planting bulbs for next spring, the fall is the time to do so. You can also fertilize your lawn, this will help to prevent damage to it over the course of the winter.

Proper maintenance of your home enhances the appeal and value of your home. Also, it can prevent critical emergencies from taking place, which are typically more expensive, time-consuming, and stressful when they occur. Ensure that when the cold weather arrives, your home is ready.

If you have any questions at all or thinking of selling this fall please don’t hesitate to give us a call for a Free Market Evaluation of your home

Have a great day!

August 31, 2015 | Categories: Buyers, Local Kitchener Waterloo, Random thoughts, Sellers, Uncategorized | Tags: condo, condo buying, condo documents, condo in kitchener, condos in kitchener, facebook, first time home buyer, full time realtor, home buying, home value, inventory levels, kevin baker, kitchener, Kitchener waterloo, kwhometeam, lofts in kitchener, market update, Mortgage News, real estate, real estate investing, Remax, sales rep, waterloo ontario, waterloo region school board | Leave a comment

Busy Month For Kitchener Waterloo Home and Condo Sales In June 2015

Its been a very busy home buying and selling season in June for the residents of Kitchener Waterloo and Waterloo Region. There were 626 homes sold through the Multiple Listing System (MLS® System). This represents a 9.4% increase compared to June of 2014, and 15.8% above the 5 year average for the month June.

Residential sales in the first half of 2015 totaled 2,949, an 8.1% increase compared to the same time last year, and 2.7% above the 5-year average. This marks the highest number of homes sold in the first half of the year since 2010.

On a year-to-date basis, the average sale price of all residential sales (KW and area) increased 2.6% to $347,105 compared to 2014. Single detached homes sold for an average price of $396,191 an increase of 1.3% compared to last year. The average sale price for a condominium units sold in the first half of the year was $235,081, an increase of 5.3 per cent over 2014. The housing market in Kitchener-Waterloo continues to show strength Buyers have confidence in Waterloo Region, that combined with low mortgage and interest rates should continue to support home sales in 2015.

Sales for the month of June in KW and area included 407 single detached homes (up 7.1 %), 137 condominium units (up 24.5%), 42 semi-detached (up 7.7%) and 35 freehold townhouses (down 12.5%). Across KW and area the average sale price of all residential sales through the Kitchener Waterloo MLS® System increased 0.2% to $351,259 compared with June 2014.

Looking at transactions strictly in the cities of Kitchener-Waterloo residential sale prices increased 3.2 percent to $344,405 compared to the same time last year. Single detached homes sold in June across KW and area had an average price of $408,569 an increase of 0.9% compared to last year. Condominium market prices were up 4.2%, with the average condo unit selling for $225,390.

If you have any questions or would like more specific neighborhood information about your home please feel free to give me a call 519-497-4646 or email direct at kevinbaker@kwhometeam.ca

Thanks

Kevin

July 8, 2015 | Categories: Buyers, Local Kitchener Waterloo, Random thoughts, Sellers, Uncategorized | Tags: Bank of Canada, banking practices, condo, condo buying, condo documents, condo in kitchener, eastbridge, first time home buyer, full time realtor, home buying, home value, inventory levels, kevin baker, Kitchener waterloo, kwhometeam, kwrealestatelife, lofts in kitchener, market update, real estate, real estate investing, Remax, sales rep, waterloo ontario, waterloo region school board | Leave a comment

Strong Home Sales In May Continue To Drive Prices for Kitchener Waterloo

It was another fantastic month for the local real estate market here in Waterloo Region .There were 553 home sales in Kitchener-Waterloo and surrounding area through the Mls system.

This represents an 8.4% increase compared to May of 2014, and 9.6% above the 5 year average for the month May. With a total of 2,926 home sales occurring through the Kitchener Waterloo Real Estate Board, year-to-date sales are 3.3% above the five year average.

Although sales numbers in Kitchener-Waterloo are higher in comparison to May of last year, they are on par with the month of April, at 1.7% above last month’s residential sales numbers, a difference of nine home sales. It’s been a very busy but typical spring market. Low mortgage interest rates and a diverse local economy continue to support home buying in Waterloo region.

Much like the month of April, sales activity in the $300,000 – $349,999 posted a healthy increase in the month of May with 126 homes sold in that range, a 24.8% increase from the same time last year. Sales in the $400,000 – $499,999 also increased with 81 sold in this price range, a 28.6% increase.

Sales in KW included 355 single detached homes (up 4.7 %), 113 condominium units (up 28.4%), 44 semi-detached (up 2.3%) and 40 freehold townhouses (up 8.1%). The average sale price of all residential sales through the Mls, increased 1.6 percent to $343,750 compared to May 2014. Single detached homes sold for an average price of $390,704 an increase of 1.1% compared to last year. Condominium market prices were up 7.1%, with the average condo unit selling for $237,649.

If you have any questions or are thinking of buying or selling in the coming months feel free to give me a call.

Have a great week!

Kevin

June 8, 2015 | Categories: Buyers, Local Kitchener Waterloo, Random thoughts, Sellers, Uncategorized | Tags: Bank of Canada, condo, condo buying, condo documents, condo in kitchener, condos in kitchener, eastbridge, first time home buyer, full time realtor, home buying, home inspection, home value, inventory levels, kevin baker, kitchener, Kitchener waterloo, kwhometeam, loft, lofts in kitchener, market update, Mortgage News, real estate, real estate investing, Remax, waterloo, waterloo ontario, waterloo region school board | Leave a comment

CMHC Raises Mortgage Premium for High Risk Buyers – Kitchener Waterloo Homes and Condos

Are you looking to get into the market? Are you a first time buyer with less than 10% down?

If so then you need to be aware of recent changes to the mortgage insurance premiums that are offered through CMHC (Canadian Mortgage and Housing Corporation)

It was announced a few days ago that Canada’s federal housing agency is raising mortgage insurance premiums as part of a plan to boost its capital reserves.

Canada Mortgage and Housing Corp. said it is raising premiums on the highest-risk mortgages – borrowers who have down payments of less than 10 per cent – by 15 per cent starting June 1.

What does this mean for buyers?

The increases only apply to new mortgages for borrowers with small down payments. Those who put down more than 10 per cent of the purchase price aren’t affected. Premiums will also remain unchanged on CMHC’s portfolio insurance, which lenders take out on bundles of uninsured mortgages so they can securitized them, as well as the agency’s insurance for apartment buildings.

The effects will be modest for affected borrowers. An average Canadian borrower who can afford to pay the only the minimum 5-per-cent down payment typically takes out a mortgage of $252,000, CMHC said. Premiums for those borrowers would rise $5 a month, or about $1,500 more over the course of a 25-year mortgage.

CMHC predicted the changes would “not have a material impact on housing markets,” suggesting the agency isn’t looking to cool the housing market. Senior vice-president Steven Mennill stressed in a call with reporters that the changes were a “business decision” related to higher capital requirements and “not in any way related to a change in policy or approach.”

One thing is clear: By limiting increases only to borrowers with less than 10-per-cent down payments, the federal corporation is concerned that it was underpricing the risk on the most indebted borrowers.

Mortgages with lower levels of equity are typically more vulnerable to a housing shock and require higher levels of capital reserves to account for potential losses, which means higher premiums for riskier borrowers.

My advice would be is if you are thinking of buying a home this spring and have less than a 10% down payment that you take advantage of the lower premiums offered before June 1st.

For more details or questions please email myself at kevinbaker@kwhometeam.ca or give us a call at 519-579-4110

Enjoy your week!

Kevin

April 8, 2015 | Categories: Buyers, Local Kitchener Waterloo, Uncategorized | Tags: Bank of Canada, canadian mortgage housing corporation, cmhc, condo, condo buying, first time home buyer, full time realtor, home buying, home value, kevin baker, Kitchener waterloo, lofts in kitchener, market update, Mortgage News, Mortgage Rates, real estate, real estate investing, Remax, sales rep, waterloo ontario | Leave a comment

Kitchener Waterloo Home Sales Trend Up in March

It was another solid month of home sales in March here in Waterloo Region. Residential property sales through the MLS system continued to climb month over month with 619 properties sold. This represents a 15.1 percent increase compared to the March of 2014 which was the second lowest March on record since 2006.

During the first quarter of 2015, there were a total of 1,343 home sales, 3.6 percent above last year’s total for the same period and 8.4 percent below the 5 year quarterly average, which is again great news and shows continued strength of our local housing market.

Sales activity in the $300,000 – $349,999 increased significantly in the month of March with 151 homes sold in that range, a 49.5% increase from the same time last year. Pushing the average sales price up for the month were increased sales in the $500,000 – $749,999 range which posted a 61.5% increase equating to 63 sales compared to 39 in March 2014.

March’s sales included 436 single detached homes (up 25.3 %), 95 condominium units (down 2.1 %), 41 semi-detached (down 8.9) and 41 freehold townhouses (down 6.8%).The average sale price of all residential sales increased 7.4 percent to $347,722 compared with March 2014. Single detached homes sold for an average price of $384,635 an increase of 4.0 percent compared to last year. In the condominium market prices were up 12.1%, with the average condo unit selling for $238,846.

Overall the market is still moving forward and prices remain stable. We are expecting another busy spring market which seems to be well underway at this point.

If you have any questions about the local market or would like more information on home prices for your neighborhood, please feel free to give me a call or email direct at kevinbaker@kwhometeam.ca

Thanks and have a great week!

Kevin

April 7, 2015 | Categories: Buyers, Local Kitchener Waterloo, Sellers, Uncategorized | Tags: Bank of Canada, condo, condo buying, condos in kitchener, eastbridge, first time home buyer, full time realtor, home buying, home value, inventory levels, kevin baker, Kitchener waterloo, kwhometeam, loft, lofts in kitchener, march update, market update, Mortgage News, real estate investing, real estate update, realtor, Remax, sales rep, selling your home, waterloo ontario | Leave a comment

Home Sales Remain Strong in Month of August – Kitchener Waterloo Home and Condo Market Update

With the summer over and September and the school season upon us the real estate market is back in full swing. The summer showed very good sales vs previous years with a total of 567 homes sold. The month of august posted a 9.2% increase in the home sales compared to the same month last year. Homes sales in the month of August were also 9.3% above the 5 year average for the month and were second highest on record compared to August sales in the last 5 years.

Kitchener Waterloo and the entire region continues to be strong. Higher than average sales activity in August and year-to-date speaks volumes about the confidence consumers have in our local economy and home ownership as an investment.

The breakdown of residential sales included 367 single detached homes ( up 4.9% from last year), 42 semi-detached (up 13.5%) 39 townhomes (up 77.3%) and 115 condominium units (up 11.7%). The year to date numbers are up 2.7 percent compared to the five year average with 4648 homes being sold.

If we look at average sale price of all residential homes sold through the Multiple listing service system, there was an increase of 3.9 percent last month to $329,892 compared to August 2013. Single detached homes sold for an average price of $378,251 and increase of 5.4 percent compared to last year. The average sale price for a condo unit was $225,167 an increase of 1.5 percent and the average sale price for a freehold townhome was $287,369, a decrease of 1.9 percent from the same time last year.

Overall a fantastic month in the Kitchener Waterloo Housing market. We expect the trend to continue in to the fall selling season as well.

If you have any questions or would like more specific pricing on your home or something that you are looking at purchasing please feel free to give me a call at 519-579-4110 or email direct to kevinbaker@kwhometeam.ca

September 8, 2014 | Categories: Buyers, Local Kitchener Waterloo, Random thoughts, Sellers, Uncategorized | Tags: August, condo, condo buying, condo documents, condo in kitchener, fall market, first time home buyer, full time realtor, home value, Kitchener waterloo, loft, market update, real estate investing, realtor, Remax, seagrams, seagrams loft, twin city, waterloo ontario | Leave a comment

Kitchener Waterloo Real Estate Market Update for June 2104

It was another solid month for home sales in Waterloo Region. Although the number of sales was down compared to last year they were up compared to the 5 year average. Prices were also up which is a great sign that the buyers are still out there and looking to make a move. If you have any questions or would like more specific pricing on your home please don’t hesitate to give me a call.

STEADY STREAM OF HOME SALES FOR THE MONTH OF MAY

KITCHENER-WATERLOO, ON (June 4, 2014) –– Residential property sales through the Multiple Listing

System (MLS® System) of the Kitchener-Waterloo Association of REALTORS® (KWAR) in May were down

5.6 percent compared to last year’s record setting month of May.

A total of 725 residential properties were sold in the month of May compared to 768 the same time

last year. This was only the second time since 2007 that residential sales in May have exceeded 700

total sales. Comparing the 5-year average for the month of May shows a 5.7 percent jump in

residential sales.

“The spring home buying season was in full swing this May” says Lynn Bebenek, President of KWAR.

“Strong sales and price gains reflect the confidence homebuyers have in regional housing market as

a great place to live and invest.”

May’s sales included 514 single detached homes (down 3.4 % from last year) 101 condominium units

(down 17.9 %), 60 semi-detached (up 3.4 %) and 43 freehold townhouses (down 2.3 %).

The average sale price of all residential sales through the KWAR’s MLS® System increased 3.5 percent

last month to $345,323 compared with May 2013. Single detached homes sold for an average price

of $386,474 an increase of 2.1 per cent compared to last year. The average sale price for a

condominium was $226,157, an increase of 6.4 percent compared to May 2013.

June 10, 2014 | Categories: Buyers, Local Kitchener Waterloo, Random thoughts, Sellers, Uncategorized | Tags: assessment, Bank of Canada, first time home buyer, full time realtor, home buying, home value, inventory levels, kevin baker, kitchener, Kitchener waterloo, kwhometeam, lofts in kitchener, market update, real estate, real estate investing, Remax, sales rep, waterloo ontario, waterloo region school board | Leave a comment

11 Things to Think About When Buying a Home – Kitchener Waterloo Homes and Condos for Sale

Buying a house is a very difficult decision – there are large sums of money involved, the transaction costs and hassle of moving mean that you can’t just buy another house if you don’t like the one you end up with, and you don’t have enough information to make a completely informed decision. The best you can do is try to educate yourself in all aspects of the house hunt, keep a clear head and buy a house that fits your situation.

Here are some things for house buyers to be aware of when looking for a new home.

1) Location

- How far is it from where you work? Can you handle the time/money involved in the commute?

- If you have young kids or are planning to have them – how far from the grandparents from the house? They tend to be the best babysitters.

2) Budget

It’s nice to say “buy within your budget” but that might not realistic. Do a quick budget estimate, look at some houses that you might be interested in and then revise the budget or revise the houses. If you really can’t afford a house then don’t buy one. There is nothing wrong with renting.

3) Know your market

It’s critical that you know the market you are looking in. The asking prices for houses are often not indicative of their true value and the only way to be able to estimate a house value is to look at as many houses as possible. Take notes and find out what they sold for.

4) Trust your real estate agent

I would suggest that most house buyers use an agent. They know the local market, the pricing and can point out things that you may miss on your walk through. They protect you legally but making sure that clauses and conditions are put into the offer making sure you get everything that you are expecting.

5) Don’t end up house poor

Sometimes house buyers “fall in love” with a house or neighborhood or even just the idea of owning a house and they place too high a priority on it. This can lead to regret when the novelty wears off and you don’t have any money to do the things you like to do. Try living for six months on a “pretend” mortgage payment and see how it goes.

6) Take your time

Until recently, many buyers were afraid of missing out on future price gains or being “priced out of the market”. If you are renting and saving as much as you can, then you will be fine. Here are some tips for renters to be able to keep up (or down as the case may be) with their house owning friends. Note – this one isn’t as relevant as it was last year!

7) Make a decision

Previously, I said to look at lots of houses to learn the market. At that point you should be able to purchase a house fairly quickly. If you are looking for the perfect house or trying to time the market then you will never buy a house. I know people who did ten year house searches which is a big waste of time. The reality is that you will be happy with a good percentage of all the houses you look at, so as long as you can eliminate the worst choices then you will be thrilled with your new home.

8) Don’t worry about the down payment

Yes, I know – it sounds pretty shocking in the sub-prime era to suggest that a down payment of less than 20% is acceptable, but in my opinion, the ability to make the mortgage payments is the main factor for affordability. In other words, it’s the size of the mortgage that matters. Of course you can get better rates with a larger down payment so it’s better if you have one, but don’t sweat it if you have a small or zero down payment.

9) Don’t blow your budget on renovations and furniture

Most people end up buying a house that has mortgage payments large enough that the buyers have to “make the payments fit” into their budget. While this is not the best way to buy a house, some of these buyers then make things worse by spending more money on renovations and house decorations. Unless you buy a total wreck of a house, you do not need to spend big bucks on renovations. You can live with the non-granite kitchen counter and the couch set that doesn’t fit the room perfectly. I don’t care if the house has full-on 70′s decor – you can live with it for a year or more until you can fit the extra expense in your budget.

10) Be careful of flip properties

There are people and contractors who will buy a house, fix it up very quickly and turn around and sell it for profit. The problem with these houses is that they tend to look very good on the surface ie nice paint, trim, granite counters etc, but on the inside they are pretty ugly and might have substandard electrical, insulation etc.

If you are interested in one of these houses then make sure they have closed permits and check with the inspector to see if their inspection notes. Better yet, just don’t buy one.

11) Don’t buy the perfect house

If the house is livable and you have a good life, then you will be happy with whatever house you end up buying. If you spend more money on a “better” house, then you will quickly get used to it and will be no happier than if you had bought an “average” house.

The people inside are what make it special.

Summary

Learn as much as you can about real estate, your budget and your local house market, but be prepared for the fact that buying a house is all about compromise, incomplete information and a lot of doubts! If you keep at it however, the odds are very good that you will end up with a home that suits your needs.

May 26, 2014 | Categories: Buyers, Local Kitchener Waterloo, Random thoughts, Uncategorized | Tags: Bank of Canada, condo, condo buying, first time home buyer, full time realtor, home buying, home value, inventory levels, kevin baker, kitchener, Kitchener waterloo, kwhometeam, kwrealestatelife, lofts in kitchener, Mortgage News, real estate, real estate investing, Remax, waterloo, waterloo ontario, waterloo region school board | Leave a comment

Kitchener Waterloo April Real Estate Update – A slower March to Spring

KITCHENER‐WATERLOO HOME SALES ‐ A SLOWER MARCH TO SPRING

KITCHENER‐WATERLOO, ON (April 3, 2014) –– Residential property sales through the Multiple Listing System

(MLS® System) of the Kitchener‐Waterloo Association of REALTORS® (KWAR), were down 12 percent last month,

compared to March 2013. There were 536 residential sales reported during the month of March, 23 percent more

than in February.

Looking at the first quarter of 2013, there were a total of 1,293 residential sales, a decrease of 7.3 percent

compared to last year’s 1,395 sales.

“As everyone knows, we’ve just come off of one of the harshest winters on record”, says Lynn Bebenek, president of

the KWAR. “Anecdotally speaking I’ve heard from several business operators who say they’ve experienced a

slowdown this winter because of extreme cold and snow, and our residential real estate market was no different.”

Bebenek adds, “On the bright side, everyone has buyers waiting and hopes are resting on a busy spring.”

Home sales in March 2013 included 347 detached homes (down 13 percent), 98 condominium units (down 4.9

percent), 44 semi‐detached (down 24.1 percent), and 43 townhomes (on par).

The dollar volume of residential sales in the first quarter of 2014 came in at $423,915,584, a 5.9 percent decline

compared to the same period last year.

Single detached homes sold through the KWAR’s MLS® System in March went for an average price of $368,896,

virtually unchanged from the same month last year when the average price was $368,706. On a year‐to‐date basis,

the average price of a single detached home sold for $377,711, a 3.4 percent increase.

The average sale price of all residential sales also increased a negligible 0.1 percent to $322,833 last month

compared to the same month last year. On a year‐to‐date basis, the average price edged up a little higher to

$327,854, representing a 1.6% increase over 2013.

If you have any questions or would like a Pricing Analysis on your home please give me a call at 519-579-4110

April 4, 2014 | Categories: Buyers, Local Kitchener Waterloo, Sellers, Uncategorized | Tags: Bank of Canada, condo, first time home buyer, full time realtor, home buying, home value, inventory levels, kevin baker, Kitchener waterloo, kwhometeam, lofts in kitchener, market update, Mortgage News, real estate investing, realty, Remax, sales rep, twin city, waterloo ontario | Leave a comment

Kitchener Waterloo Home Sales Steady For February

With the cold weather still keeping its grip on us here in Kitchener Waterloo, the Residential Real Estate market is starting to show signs of life. Even though the volume of sales are down about 4% the prices are still rising steadily. Condos are leading the way for another month in a row up 6.3%.

Have a look at the entire Media release from the Kitchener waterloo real estate board and if you have any questions please don’t hesitate to give me a call.

HOMES SALES STEADY IN FEBRUARY

KITCHENER-WATERLOO, ON (March 5, 2014) –– Residential sales through the Multiple Listing System (MLS®) of the

Kitchener-Waterloo Association of REALTORS® (KWAR) were down 4.0 percent in February compared to the

same month last year and up 34 percent compared to January’s results which were hampered by extreme

cold and snow.

A total of 431 residential properties were sold compared to 449 the same time last year. Residential sales in

February included 274 single detached homes (down 8.7% from last February), 33 semi-detached (down

13.2%), 28 townhomes (down 3.4%) and 93 condominium units (up 16.3%).

“February sales showed a healthy increase compared to January,” stated Lynn Bebenek, President of the

KWAR. “Low interest rates and a diverse and vibrant regional economy will continue to support a stable market

for the Kitchener-Waterloo area.”

Single detached homes sold for an average price of $387,288 an increase of 5.1 percent compared to last

year. The average sale price for a condominium was $233,657 an increase of 6.8 percent while townhomes and

semis sold for an average of $281,636 (down 0.7%) and $246,171 (down 3.0%) respectively. The average sale

price of all residential sales through the KWAR’s MLS® System increased 3.0 percent to $335,217 compared to

February 2013.

“Following up on what has been one of the coldest winters on record I expect we will see home buyers and

sellers out in full force come the spring time,” said Bebenek.

March 5, 2014 | Categories: Buyers, Local Kitchener Waterloo, Sellers, Uncategorized | Tags: assessment, Bank of Canada, condo buying, February market update, first time home buyer, full time realtor, home buying, home value, inventory levels, Kitchener waterloo, kwrealestatelife, loft, lofts in kitchener, market update, Mortgage News, real estate, real estate investing, realty, Remax, twin city, waterloo ontario, waterloo region school board | Leave a comment

CMHC Premiums are Going Up – Kitchener Waterloo Homes for sale

CMHC (Canadian Mortgage Housing Corporation) Announced that their Loan Insurance Program is going to be changing. What does that mean for Canadians purchasing properties with less than 35% down? Have a look at the chart below to see how the costs will be changing. If you have any questions or would like any advice please give us a call

March 3, 2014 | Categories: Buyers, Local Kitchener Waterloo, Sellers, Uncategorized | Tags: Bank of Canada, banking practices, cmhc, condo, first time home buyer, full time realtor, home buying, home value, inventory levels, Kitchener waterloo, lofts in kitchener, Mortgage News, Mortgage Rates, real estate investing, Remax, sales rep, waterloo ontario | Leave a comment

Mortgage Down Payment – It Might Be Easier Than You Think

For many first-time homebuyers, saving the 5 per cent downpayment is one of the big obstacles to home ownership, especially if you’re paying rent, paying down student loans, and trying to live a life. Here are some programs and tips that can give your downpayment a boost – to get you into your home faster:

- The federal Home Buyers’ Program (HBP) lets first-time homebuyers withdraw up to $25,000 each (or $50,000 for a couple) tax-free from their RRSPs. You’ll need to pay those funds back, of course, on a repayment plan.

- A financial gift from a parent or blood relative can be used as a downpayment. You’ll need to document in writing that the funds are a gift and that you are not required to pay the money back at any time.

- A parent or grandparent could also provide a loan with a modest interest rate and reasonable expectations for loan repayment. Or you could look at borrowing the downpayment through a loan or unsecured line of credit.

- If your dream home is out of reach, look for a starter home. Use today’s low interest rates to start hammering down your mortgage, then watch for the opportunity to get the home of your dreams – using the equity and credit rating you’ve been building!

If you have any questions regarding down payments or Mortgages in general feel free to give us a call. We are happy to help

March 3, 2014 | Categories: Buyers, Local Kitchener Waterloo, Random thoughts, Sellers | Tags: Bank of Canada, banking practices, condo, first time home buyer, full time realtor, home buying, home value, kevin baker, Kitchener waterloo, kwrealestatelife, loft, lofts in kitchener, market update, Mortgage News, real estate, real estate investing, Remax, waterloo ontario | Leave a comment