Home Sales Surge in July for Kitchener Waterloo and Cambridge

Hope you enjoyed a wonderful long weekend and the beautiful summer weather we have been having.

It was another crazy month for home prices here in Waterloo Region. Competition stays very high for buyers looking to lock down a house in July. With the rules around covid relaxing and more people getting out with Phase 3 opening the demand for homes has increased for sure.

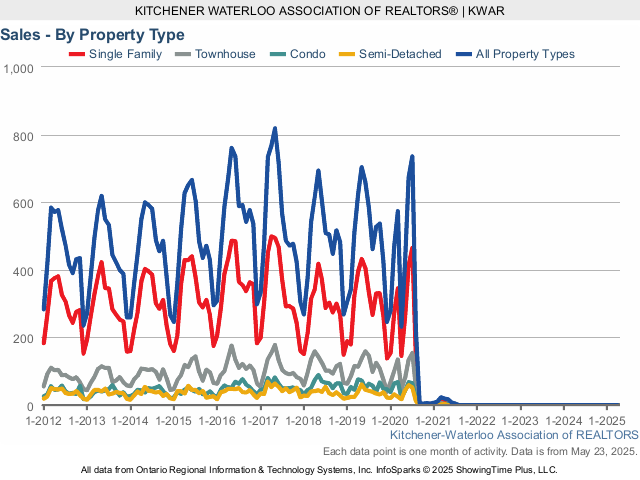

There were 734 residential homes sold in July, an increase of 25.7 per cent compared to the same month last year, and well above the previous ten-year average for July of 531.

Total residential sales in July included 464 detached homes (up 39.3 per cent from July 2019), and 65 condominium apartments (up 3.2 per cent). Sales also included 153 townhouses (up 4.8 per cent) and 52 semi-detached homes (up 23.8 per cent).

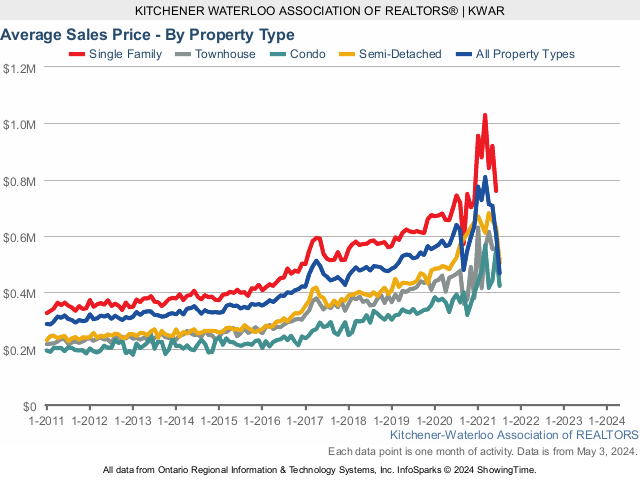

The average sale price of all residential properties sold in July increased 22.8 per cent to $639,814 compared to the same month last year, while detached homes sold for an average price of $745,149 an increase of 21.4 per cent. During this same period, the average sale price for an apartment-style condominium was $392,770 for an increase of 15.2 per cent. Townhomes and semis sold for an average of $465,756 (up 12.8 per cent) and $522,872 (up 20.4 per cent) respectively.

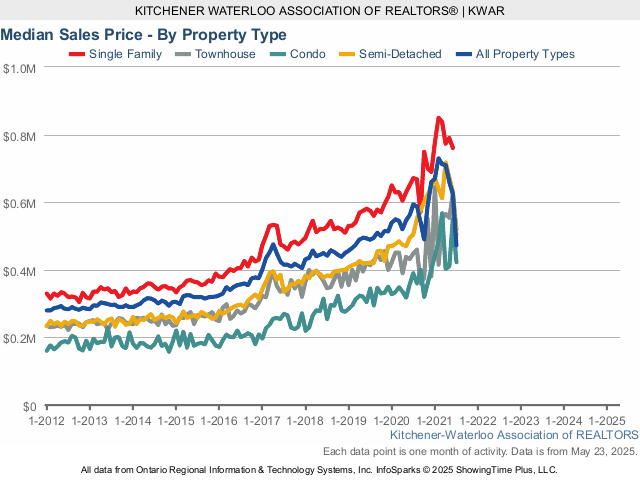

The median price of all residential properties sold in July increased 21.7 per cent to $595,000 and the median price of a detached home during the same period increased 17.4 per cent to $675,000.

With mortgage rates near all time lows homebuyers remain very confident about owning a home in Waterloo Region and I expect this to contunie going into the fall.

There were 888 new listings added, an increase of 4.3 per cent compared to July of last year, and 15.5 per cent more than the previous ten-year average for July.

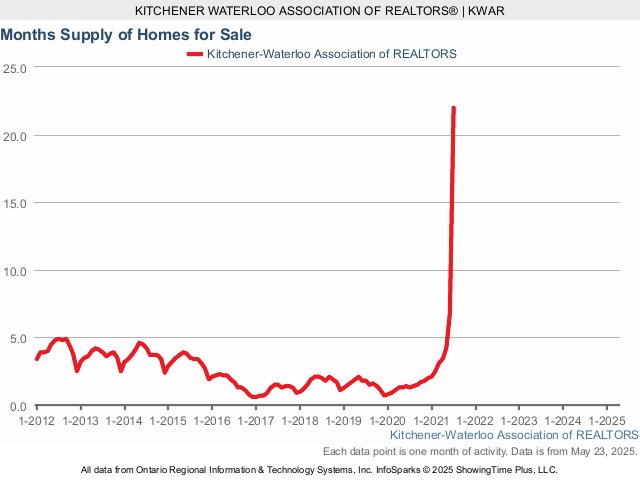

The total number of homes available for sale in active status at the end of July was 592, a decrease of 32.6 per cent compared to July of last year.

The number of Months Supply (also known as absorption rate) continues to be very low at just 1.3 months for the month of July, 27.8 per cent below the same period last year. The previous ten-year average supply of homes for July was 3.1 months, and in the past 5 years, the average supply for July was 2.1 months.

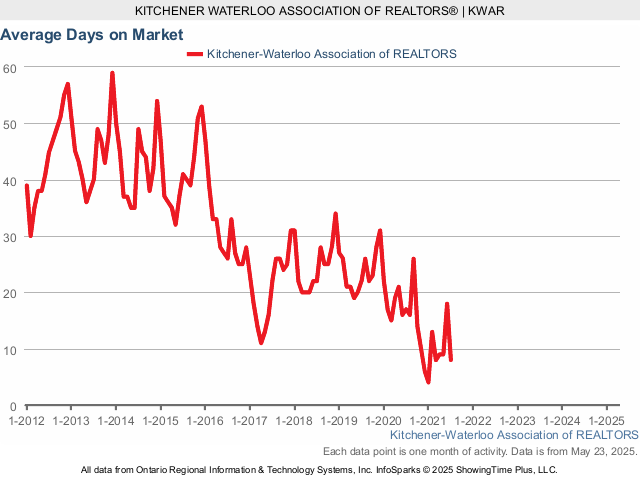

The average days to sell in July was 17 days, compared to 22 days in July 2019.

Historical Sales By Property Type

Months Supply of Homes for Sale

Historical Median Sales Price – By Property Type

Historical Average Sales Price – By Property Type

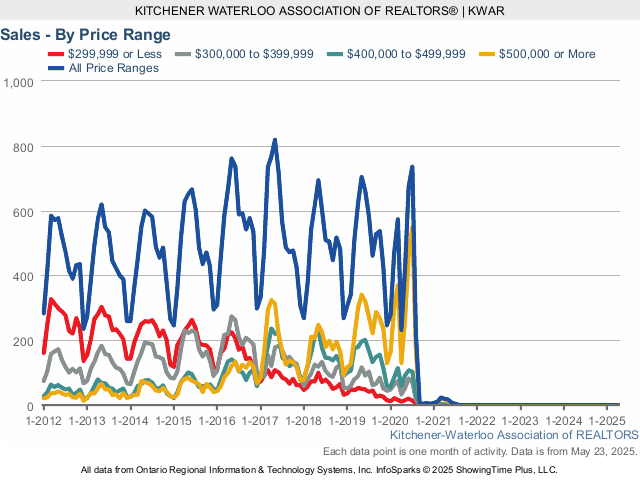

Historical Sales – By Price Range

If you are thinking of buying or selling in the coming months or have any questions at all, give me a call, text at 519-497-4646 or shoot me an email to kevinbaker@kwhometeam.ca Stay healthy and stay safe!

Have a great weekend!

Kevin

August 6, 2020 | Categories: Buyers, Local Kitchener Waterloo, Random thoughts, Sellers, Uncategorized | Tags: 2019, activa, apple butter, appraisal, arrow, assessment, August, backyard, Bank of Canada, banking practices, basketball, bauer, bee's, beechwood, being social, bird droppings, board of education, breslau, brokerage, business online, cambridge, canadian, carbon monoxide, chicopee, cibc, city center, city centre, closing costs, closing paperwork, cmhc, colonial acres, commission, condo, condo buying, condo documents, condo for sale, condo market, condo prices, condo sales, condo values, condos, corona, crafts, district, down payment, downsizing, downtown, downtown kitchener, due diligence, eastbridge, elmira, energy audit, exclusive, facebook, fall, fall market, fear, february, festival, first time home buyer, for sale, forest heights, forest hill, free home evaluation, full time realtor, fun fact, fun stuff to do., garment, gas furnace, goal setting, government, green homes, guelph, harmonized sales tax, home buying, Home energy audit, home for sale, home inspection, home maintenance, home ownership, home price, home prices, home sales, home selling, home staging, home value, home values, homes, homes for sale, hornets, house, house for sale, house price, house prices, house sales, house value, houses for sale, housing update, hst, hydro, interest rate, investment, january, june, kaufman, kevin baker, kitchen cabinets, kitchener, Kitchener waterloo, kitchner, land transfer tax, landlord, laurelwood, laurentian, lawyer, lawyers, lexington, licensing, listing your home, loft, loft for sale, loft style, lofts, mansion, march, march update, market update, market value, marketing, may, midtown, midtown lofts, mls, mortage rates, mortgage, Mortgage News, Mortgage Rates, mortgage rules, mortgages, multiple listing service, multiple offer, networking, new construction, newspaper, november update, older homes, Olympic gold, online advertising, ontario, open house, open houses, opportunity, options for homes, painting, pioneer park, price, prices, pricing your home, Prime rate, private, privately, rates, rbc, real estate, real estate agent, real estate investing, real estate lawyer, real estate lawyers, real estate market, real estate team, real estate update, real estate values, realtor, realty, red, region, Remax, remax agent, rental, royal bank, sale, sale price, sales, sales agent, sales rep, sales representative, saving money, selling your home, september, single detached, special assessment, spring market, stanley park, stanleypark, summer, summer market, Survivor, tanglewood, tax credit, td canada trust, teamwork, tech savvy, to do list, toronto, townhome, townhouse, transit, twin city, twitter, union station, uptown waterloo, virus, waterloo, waterloo ontario, waterloo region, wellesley, westvale, winter market, winter sales | Leave a comment

New Mortgage rules for Canadians has started

On October 17th, the federal government set up new guidelines for qualifying for a mortgage here in Canada. The federal government says it’s responding to concerns that sharp increases in housing prices in Toronto, Vancouver and elsewhere could increase defaults in the future, should historically low interest rates finally start to climb.

One of the key changes is that homeowners will be subject to a mortgage rate stress test beginning Oct. 17. It does not matter what size of down payment they have. Before now, those with less than a 20 per cent down payment were required to pass a stress test and have mortgage insurance backed by the federal government through the Canada Mortgage and Housing Corporation.

The test measures whether the buyer could still afford to make payments if mortgage rates rose to the Bank of Canada’s posted five-year fixed mortgage rate.

That rate is usually significantly higher than what a buyer can negotiate with banks or other lenders. For instance, TD has a five-year fixed rate mortgage at 2.59 per cent, while the Bank of Canada’s rate is 4.64 per cent.

The stress test also sets a ceiling of no more than 39 per cent of household income being necessary to cover home-carrying costs such as mortgage payments, heat and taxes.

It has been said that Regulators are under intense pressure to do something because home prices are climbing fast and may be over-valued in some markets. They want to avoid any kind of catastrophe on their watch..

So is this a good thing for Canadian housing? Many markets outside of the larger centers are also experiencing a sharp increase in house prices. Here in Kitchener Waterloo, the demand for medium priced homes is literally a bidding war with many homes selling for far more than i think they should be. That being said, prices are a reflection of supply and demand so that current pricing is a direct result of many more buyers than sellers.

The new rules also mean that, beginning this tax year, all home sales must be reported to the Canada Revenue Agency. The gains from sales of primary residences will remain tax-free, but the government is aiming to block foreign buyers from purchasing and flipping homes while falsely claiming the primary residence exemption from capital gains tax.

It remains to be seen whether these steps will tighten the current market, expand or collapse it. My only advice is that if you are thinking of selling your home this fall that you take advantage of the extremely low inventory levels that we have in Waterloo region.

Give me a call and we can grab a coffee and discuss the best solution for you and your family. You can reach me at 519-497-4646 or email to baker_kevin@rogers.com

Have a great day

Kevin

October 26, 2016 | Categories: Buyers, Local Kitchener Waterloo, Random thoughts, Sellers, Uncategorized | Tags: cambridge, canadian, cmhc, home buying, home prices, home selling, house prices, kitchener, mortgage, mortgage rules, Remax, twin city, waterloo, waterloo region | Leave a comment