Strong Home Sales Continue here in Kitchener, Waterloo and Cambridge

Hope you had a wonderful Halloween and here is hoping the snow stays away for a little while longer. I wanted to shoot you a quick update on how the real estate market did in November here in Waterloo Region.

There were 538 residential properties sold here in Kitchener-Waterloo in October, an increase of 4.1 per cent compared to the same month last year.

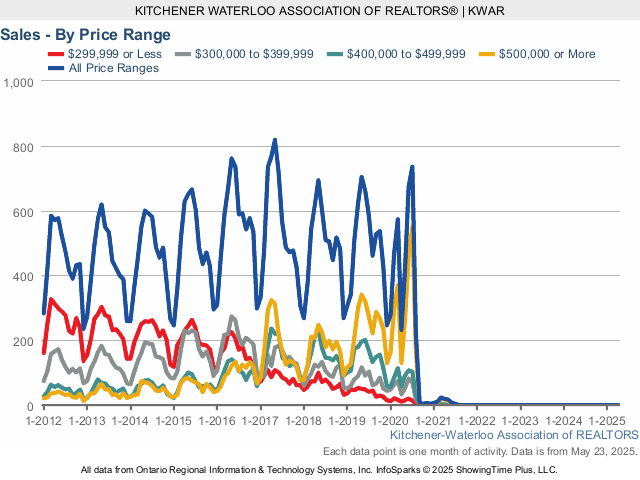

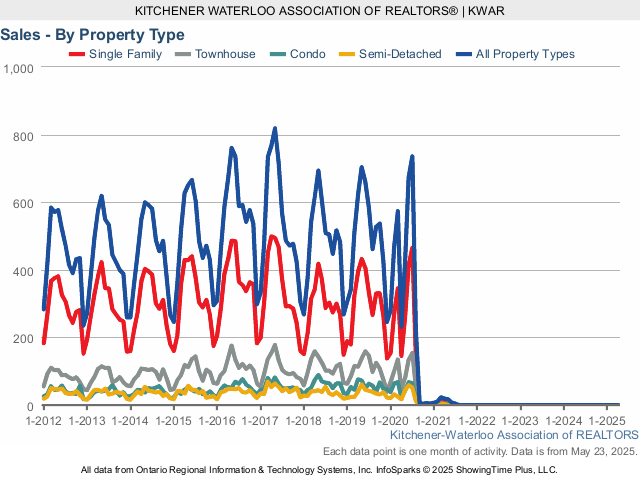

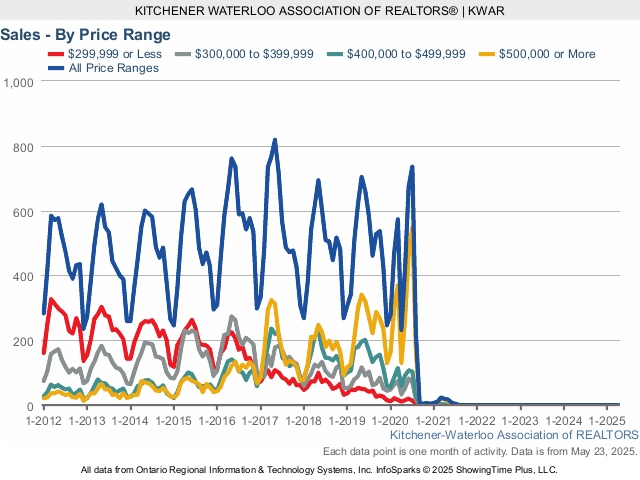

Home sales in October included 334 detached (up 11.3 per cent), and 65 condominium apartments (up 1.6 per cent). Sales also included 108 townhouses (down 6.1 per cent) and 31 semi-detached homes (down 18.4 per cent).

The average sale price of all residential properties sold in October increased by 9.1 per cent to $533,288 compared to October 2018. Detached homes sold for an average price of $610,840 (an increase of 6.2 per cent compared to October of last year. During this same period, the average sale price for an apartment-style condominium was $333,895 for an increase of 6.7 per cent. Townhomes and semis sold for an average of $434,035 (up 11.2 per cent) and $461,590 (up 14.3 per cent) respectively.

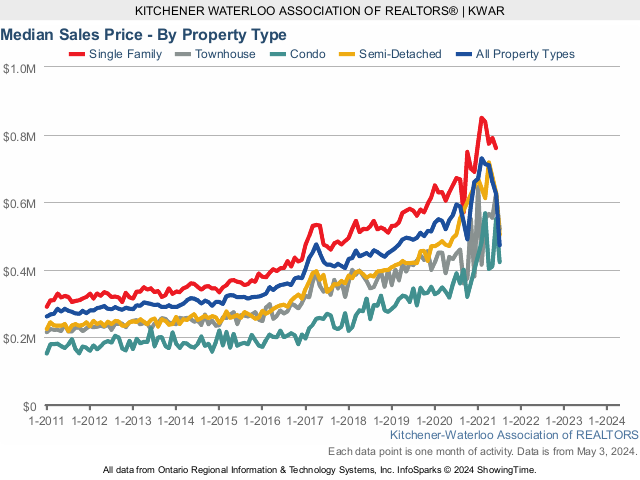

The median price of all residential properties sold last month increased 12.4 per cent to $500,000 and the median price of a detached home during the same period increased by 8.3 per cent to $568,950.

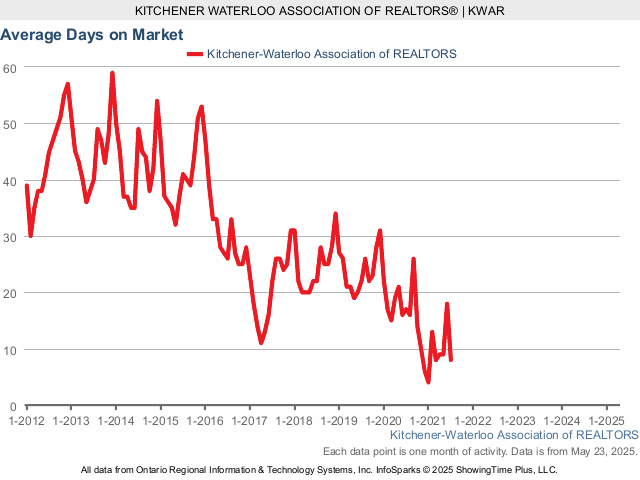

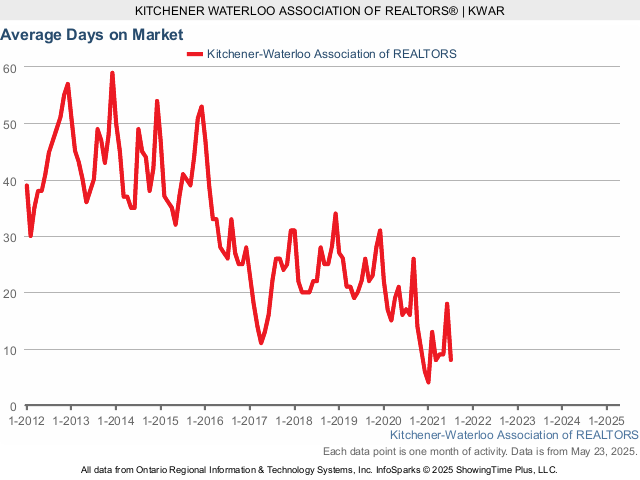

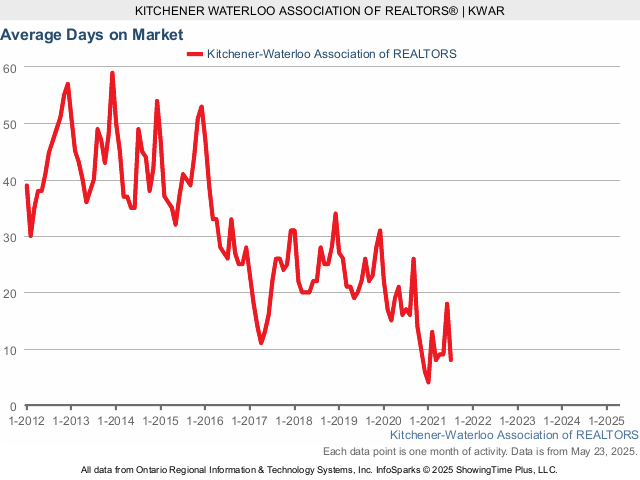

The average days it took to sell a home in October was 22 days, which is three days fewer than it took in October 2018.

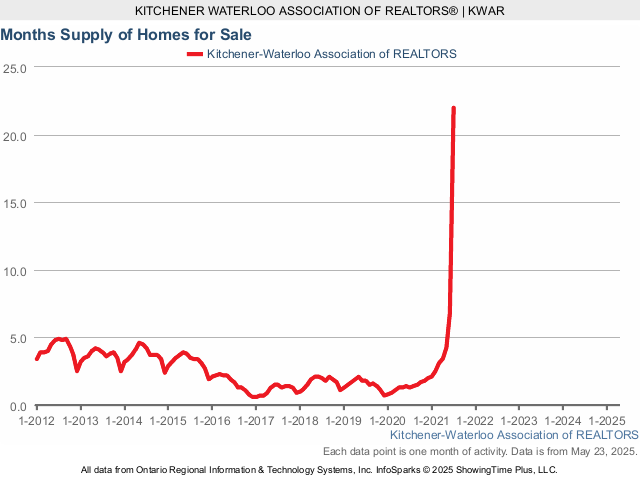

There were 670 residential properties listed in K-W and area last month, a decrease of 12.4 per cent compared to October of 2018, and a decrease of 3.3 per cent in comparison to the previous ten-year average for the month of October. The total number of homes available for sale in active status at the end of October totalled 691, a decrease of 26.5 per cent compared to October of last year, and well below the previous ten-year average of 1,412 listings for October. Months Supply of Homes for sale stood at 1.4 months in October, which is 26.3 percent lower than the same period last year. The previous ten-year average months supply of homes for October was 3.03.

Seasonal strength in October is common as people to look to make moves before Winter. With a scarcity of listings, buyers continue to snap up properties in the Kitchener-Waterloo area at a fast pace.

Here are some charts….

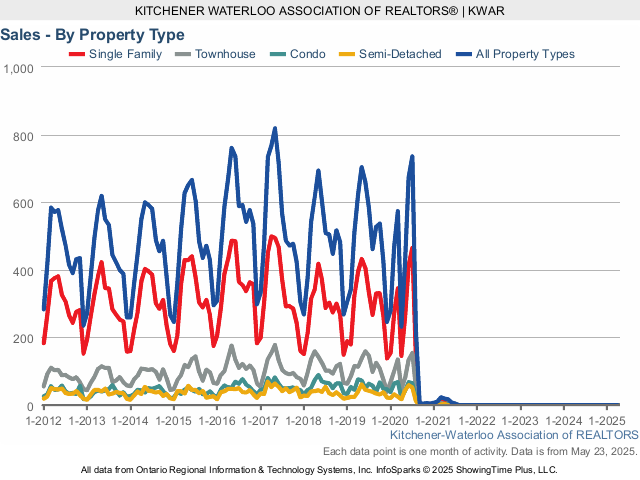

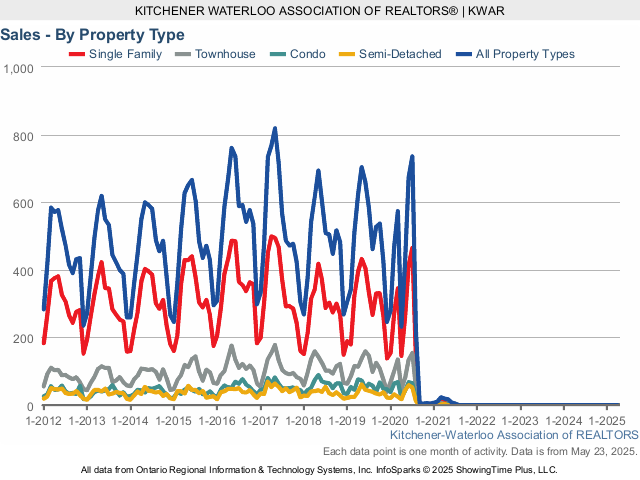

Historical Sales by Property Type

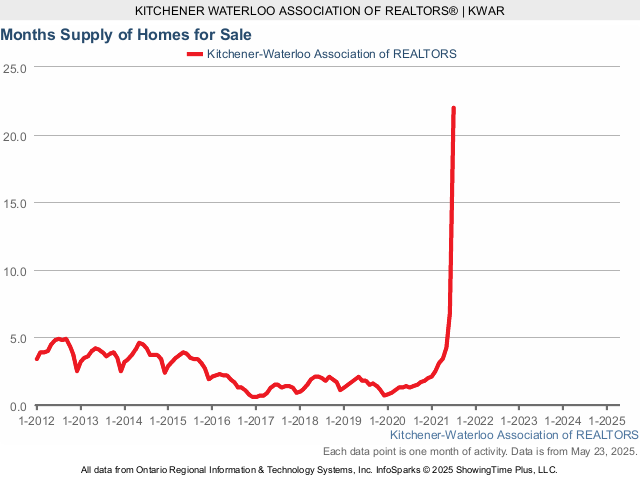

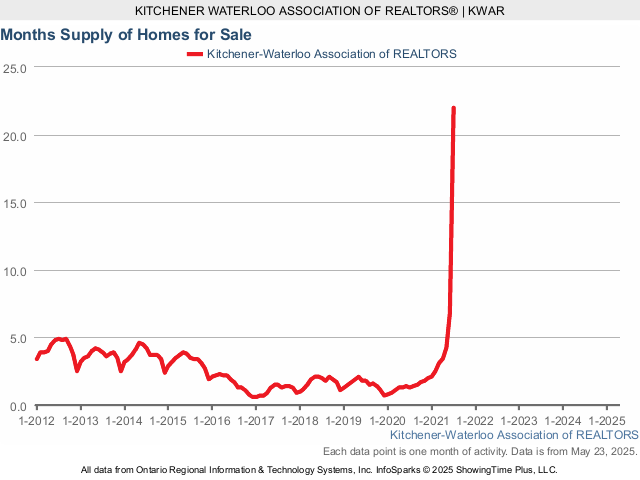

Months Supply of Homes for Sale

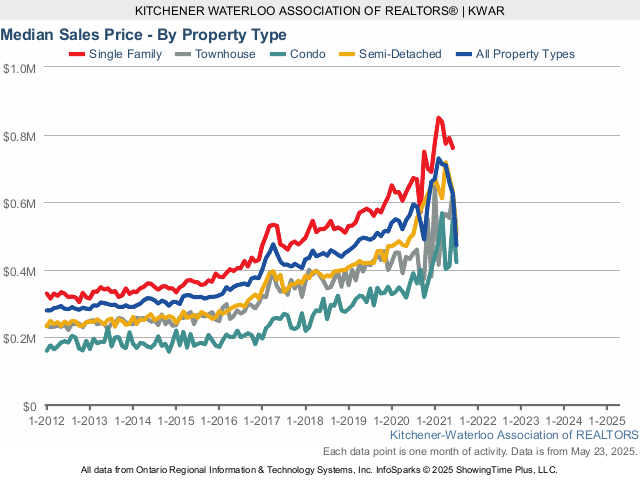

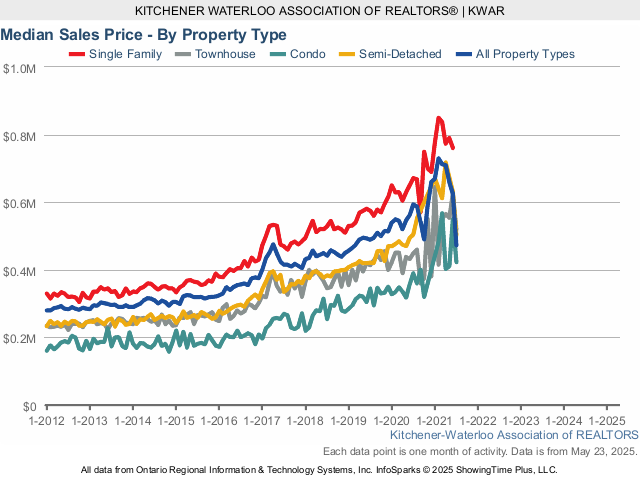

Historical Median Sales Price – By Property Type

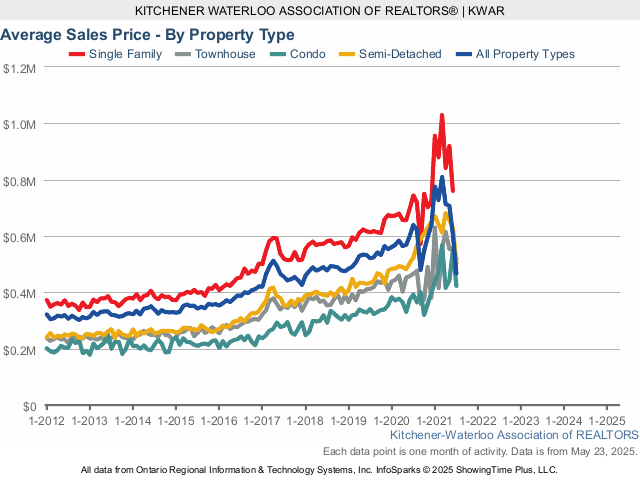

Average Sales Price – By Property Type

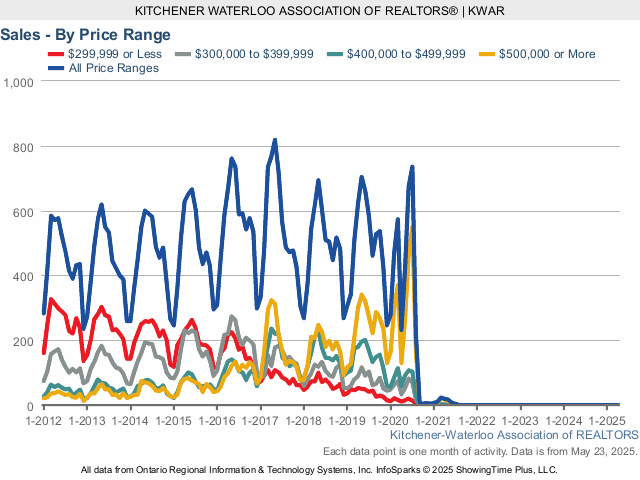

Historical Sales – By Price Range

If you have any questions or have been thinking of making a move this fall, give me a call or text at 519-497-4646 or shoot me an email to kevinbaker@kwhometeam.ca and lets sit down, grab a coffee and plan out a strategy that is best suited for your families needs.

Have a great November!

Kevin

Strong Home Sales for June here in Waterloo Region

Hope you had a wonderful long Canada Day weekend. The weather was absolutely perfect and looks like its going to be a hot one for July.

Here are the stats from the July and the market here in Waterloo Region continues to stay strong. There were 658 residential properties sold through the Multiple Listing System (MLS® System) in June, representing an increase of 8.8 per cent compared to the same month last year.

Home sales in June included 404 detached (up 8.9 per cent), and 50 condominium apartments (down 28.6 per cent). Sales also included 159 townhouses (up 27.2 per cent) and 45 semi-detached homes (up 15.4 per cent).

A total of 3,154 homes have sold in Kitchener-Waterloo and area during the first half of this year, an increase of 1.4 per cent compared to 2018.

The average sale price of all residential properties sold in June increased by 8.9 per cent to $533,619 compared to June 2018. Detached homes sold for an average price of $618,186 an increase of 7.9 per cent compared to June of last year. During this same period, the average sale price for an apartment style condominium was $332,716 for an increase of 4.4 per cent. Town homes and semis sold for an average of $411,126 (up 10.7 per cent) and $430,427 (up 9.9 per cent) respectively.

The median price of all residential properties sold last month increased 9.9 per cent to $494,500, and the median price of a detached home during the same period increased by 11.7 per cent to $581,500

There were 888 residential properties listed in K-W and area last month, an increase of 4.3 per cent compared to June of 2018, and a slight increase of 0.5 per cent in comparison to the previous ten-year average for the month of June. The total number of homes available for sale in active status at the end of June totaled 890, a decrease of 10.8 per cent compared to June of last year, and well below the previous ten-year average of 1,581 listings for June. Months Supply of Homes for sale stood at 1.8 months in June, which is 14.3 percent lower than the same period last year.

We’re still in a solid seller’s market situation heading into the summer months, while more new listings are coming onto the market, strong buying demand is keeping supply tight.

The average days it took to sell a home in June was 20 days, compared to 22 days in June 2018.

Here are some charts to compare different parts of the market over the last 10 years.

Historical Sales By Property Type

Months Supply of Homes for Sale

Historical Median Sales Price – By Property Type

Historical Average Sales Price – By Property Type

Historical Sales – By Price Range

Historical Average Days on Market

If you have any questions or have been thinking of making a move this summer or in the fall, give me a call or text at 519-497-4646 or shoot me an email to kevinbaker@kwhometeam.ca and lets sit down, grab a coffee and plan out a strategy that is best suited for your families needs.

Have a great July!

Kevin

April Home Sales Up in Kitchener Waterloo. Average price hits all time highs!!

Hope you had a chance to enjoy the great weather we had on the weekend. It seemed like a very long winter but summer is just around the corner.

Home sales were up in April and we hit an all time high for the Kitchener Waterloo Real Estate Market average home prices which is very big news!!!

There were 623 residential sales in April, an increase of 1.1 per cent versus the same month last year, and up 2.2 per cent compared to the previous ten-year average for April.

Total residential sales in April included 394 detached (up 15.2 per cent), and 75 condominium apartments (up 1.4 per cent). Sales also included 113 townhouses (down 28.9 per cent) and 41 semi-detached homes (no change).

While sales of detached homes did jump a fair bit compared to the same month last year, they were actually on par with the previous 10-year average for April, which means we are getting back to some better market conditions for both buyers and sellers.

The average sale price of all residential properties sold in April increased by 10.9 per cent to $529,800 compared to April 2018. Detached homes sold for an average price of $611,803 an increase of 7.6 per cent compared to April of last year. During this same period, the average sale price for an apartment style condominium was $339,426 for an increase of 14.3 per cent. Townhomes and semis sold for an average of $405,013 (up 5.3 per cent) and $433,949 (up 7.7 per cent) respectively.

Average sale prices hit an all-time high in April. These are the highest sale prices we’ve ever posted in a single month. It’s only the third time the overall residential sale price has exceeded half a million, and for the first time, the average price of a detached home climbed over the 600-thousand-dollar mark.

Likewise, median prices reached an all-time high in April. The median price of all residential properties sold last month increased 11.4 per cent to $490,000, and the median price of a detached home during the same period increased by 11.1 per cent to $568,500

There were 913 residential properties listed in K-W and area last month, a decrease of 6.9 per cent compared to April of 2018, and a decrease of 1.6% in comparison to the previous ten-year average for the month of April. The total number of homes available for sale in active status at the end of April totaled 884, a decrease of 6.1 per cent compared to April of last year, but still well below the previous ten-year average of 1,485 listings for April. Months Supply of Homes for sale stood at 1.8 month in April a decrease of 5.3 per cent compared to last year.

It’s still very much a seller’s market for anyone who is looking for a home under six hundred thousand. In these challenging market conditions, i believe consumers should always seek the expert advice of a local REALTOR®.

If you have any questions or have been thinking of making a move this spring, give me a call or text at 519-497-4646 or shoot me an email to kevinbaker@kwhometeam.ca and lets sit down, grab a coffee and plan out a strategy that is best suited for your families needs.

Have a wonderful Mothers Day to all the mom’s out there.

Kevin

2018 Kitchener Waterloo Real Estate Update

Happy New Year and welcome to 2019!! I hope you enjoyed a wonderful holiday season with your family full of good food, great friends and new memories. We are only 6 days into the new year and the market is already showing signs of a busy winter and spring market to come. The stats are out and below is a recap of the numbers…

The month of December proved to continue the trend of lower sales volumes but increasing prices. There were 5,823 residential homes sold through the MLS® System in 2018, a decline of 11.1 per cent compared to 2017. With 263 transactions taking place last month, December’s home sales were down 13.2 per cent from this time last year and slightly behind the previous 10-year average of 268 sales for the month of December.

The combination of rising interest rates and the mortgage stress test definitely took some steam out of the market relative to what we saw in the previous two years. These types of impediments are most impactful on first-time as well as other buyers entering the housing market.

Total residential sales in 2018 included 3,355 detached (down 16.2 per cent), and 1,553 condominium units (up 6.4 per cent) which includes any property regardless of style. Sales also included 417 semi-detached homes (down 23.6 per cent) and 431 freehold townhouses (down 7.7 per cent).

The average sale price of all residential properties sold in 2018 increased 3.4 per cent to $483,537 compared to 2017. Detached homes sold for an average price of $575,412, an increase of 4.8 per cent compared to 2017. During this same period, the average sale price for an apartment style condominium was $304,676 for an increase of 12 per cent. Townhomes and semis sold for an average of $373,307 (up 5.5 per cent) and $396,391 (up 4.7 per cent) respectively. The median price of all residential properties sold last year increased 3.6 per cent to $445,304, and the median price of a detached home during the same period increased 6.1 per cent to $525,000.

The average time it took for a home to sell in 2018 was reflective of demand continuing to outpace supply. The number of months of inventory remained at under 2 months of supply throughout the year (3-4 months is historically normal for Waterloo region) and the average days to sell in 2018 was 24 days, compared to 19 days in 2017 and a previous 10-year average of 40 days.

While we may be seeing fewer buyers coming down the 401, they are still a component of the Waterloo region real estate market, just not as speculative as what we saw in the previous two years. 2018 continued to be a seller’s market in the region with stable sales activity and homeowners realizing solid gains in their property values.

Even though prices increased more moderately overall compared to the last two years, they continue to respond to strong demand and the desirability of our area. For those would-be buyers who have been sitting on the fence these past two years, home prices are only getting further out of reach, as supply remains low and demand strong.

Dollar volume of all residential real estate sold last year decreased 8 per cent to $2.8 Billion compared with 2017. While the majority of residential MLS® System activity is properties for sale, REALTORS® are increasingly representing landlords and tenants. Last year 733 residential leases occurred through KWAR’s MLS® System, an increase of 22 per cent compared to 2017 and, a 40% increase compared to 2016.

If you have any questions or are thinking of buying or selling in the coming months, please give me a call and we can sit down for a coffee and talk about some specific strategies that would best suit your families needs.

Have a great 2019!

Kevin

Home sales had 2nd best November on record here in Kitchener Waterloo

Hope you are having a great week and all ready for the upcoming holiday season. I wanted to take a moment to bring you up to date on what is happening in the Kitchener Waterloo real estate market. November was a great month here in Waterloo region with the 2nd best home sales on record for November.

Last month a total of 483 residential properties sold in Kitchener-Waterloo and area through the MLS® system. Home sales were up 14.2 per cent in November compared to the same month last year, and up 19 per cent compared to the previous 10-year November average of 406 sales, making it the second-best November on record.

November’s sales included 265 detached (up 9.5 per cent compared to November 2017), and 152 condominium units (up 52 per cent) which includes any property regardless of style. Sales also included 27 semi-detached homes (down 46 per cent) and 31 freehold townhouses (up 14.8 per cent). For the second straight month we are reporting stronger than average sales, which is great to see. The prospect of further interest rate increases that were indicated last month could be responsible for the current surge in home sales.

The average sale price of all residential properties sold in November increased 7.6 per cent to $477,526 compared to the same month a year ago. Detached homes sold for an average price of $580,551 an increase of 12.8 per cent compared to November of last year. During this same period, the average sale price for an apartment style condominium was $305,334 an increase of 10 per cent. Townhomes and semis sold for an average of $361,177 (down 2 per cent) and $416,878 (up 10.7 per cent) respectively. The median price of all residential properties sold last month was up 6.3 per cent compared to November of last year at $443,800 and the median price of a detached home during the same period increased 9.5 per cent to $520,000.

Waterloo region continues to be a very desirable place for purchasing a home, and affordability is a concern in Waterloo Region as we continue to see prices increase, especially for detached homes. While we believe this is more a reflection of our region being “discovered” by buyers from the GTA, it is resulting in more entry-level clients pursuing condominiums and townhomes. Combined with an ongoing tight supply of listings buyers are facing continued upward pressure on sale prices in the region. There were 597 residential properties listed in K-W and area in last month, a 1.1 per cent decrease compared to November of last year, but 18.2 per cent above the historical ten-year average of 505. However, the number of active residential listings on the Kitchener Waterloo MLS® System to the end of November totalled 888, which is 12.8 per cent lower than November of last year and 449 units fewer than the previous ten-year average of 1,337 listings for November.

If you have any questions or are thinking of buying or selling in the coming months, please give me a call and we can sit down for a coffee and talk about some strategies that would work for your family needs. I also want to wish you and your family a wonderful holiday season and all the best for 2019.

Merry Christmas!

Kevin

Stronger home sales here in Kitchener Waterloo for October

Fall is here, and that brings with it leaves falling and the beautiful colors of the season. I hope you had a great Halloween with the kids and today i thought i would let you know how the Real Estate did market here in Waterloo region.

There were 514 homes sold through the Multiple Listing System (MLS® System) in October, an increase of 7.8 per cent compared to October of last year. On a year-to-date basis 5,070 residential units have sold compared to 5,822 during the same period in 2017, a decrease of 12.9 per cent. It was a stronger than average October for home sales and listing activity for sure. Gradually increasing interest rates could be nudging both buyers and sellers from the sidelines of the housing market in my opinion.

Residential sales in October included 297 detached (up 4.6 per cent compared to October 2017), and 128 condominium units (up 19.6 per cent) which includes any property regardless of style (i.e. semis, townhomes, apartment, detached etc.). Sales also included 36 semi-detached homes (down 18.2 per cent) and 47 freehold townhouses (up 23.7 per cent).

The average sale price of all residential properties sold in October increased 7.7 per cent to $489,725 compared to the same month a year ago. Detached homes sold for an average price of $576,731 an increase of 6.2 per cent compared to October of last year. During this same period, the average sale price for an apartment style condominium was $310,215 an increase of 24.1 per cent. Townhomes and semis sold for an average of $387,602 (up 10.9 per cent) and $403,750 (up 13.8 per cent) respectively.

The median price of all residential properties sold last month was up 6.5 per cent compared to October of last year at $444,500 and the median price of a detached home during the same period increased 8.5 per cent to $525,350. Not surprisingly we’re seeing the biggest surges in average price happening in the denser forms of housing such as condos. This is partly a reflection of demand being strongest in the entry-level price ranges as well as there being more newly constructed units in the mix.

New listings totaled 760 residential properties in K-W and area in last month, a 14 per cent increase compared to October of last year, and 12.7 per cent above the historical ten-year average of 674. The number of active residential listings at the end of October totaled 1,014, which is 21 per cent higher than October of last year but still 461 units fewer than the previous ten-year average of 1,475 listings for October.

If you have any questions or are thinking of buying or selling a property in the coming months, please give me a call at 519-497-4646 or email to kevinbaker@kwhometeam.ca and we can sit down, grab a coffee and discuss the best way to make it a smooth move for your family.

Enjoy your week!

Kevin

Monthly Home Sales Up in August for first time in 2018 Here in Kitchener Waterloo

Back to school is here and so is the fall market. I hope you enjoyed your summer and continue to enjoy the great weather we are still having! August was a fantastic month in Waterloo Region real estate and here are the stats on how things went.

August home sales were down 0.8 per cent compared to last month and up 4.8 per cent compared to August of last year. A total of 505 residential properties sold in August compared to 482 the same time last year. For the first time this year we saw monthly home sales increase on a year-over-year basis. On a year-to-date basis, we’re still well below last year’s record-breaking number of home sales but still in line with historical averages.

Residential sales in August included 301 detached (up 5.2 per cent compared to August 2017), and 129 condominium units (up 25.2 per cent) which includes any property regardless of style (i.e. semis, townhomes, apartment, detached etc.). Sales also included 35 semi-detached homes (down 30 per cent) and 33 freehold townhouses (no change).

The average sale price of all residential properties sold in August increased 11.5 per cent to $493,358 compared to the same month a year ago. Detached homes sold for an average price of $583,564 an increase of 13 per cent compared to August of last year. During this same period, the average sale price for an apartment style condominium was $335,827 an increase of 14.1 per cent. Townhomes and semis sold for an average of $350,803 (up 4 per cent) and $401,011 (up 13.6 per cent) respectively. The median price of all residential properties sold last month was up 10.4 per cent compared to August of last year at $458,000, and the median price of a detached home during the same period increased 18.1 per cent to $543,450.

REALTORS® listed 670 residential properties in K-W and area last month, up 12.7 per cent compared to August of 2017, and 3.4% above the historical (2007-2016) average of 648. The number of active listings to the end of August totaled 917, which is 11.5 per cent higher than August of last year but still significantly below the historical (2007-2016) ten-year average of 1,550 listings for August.

More homes selling in the higher prices ranges in August were at least partly responsible for the increase in the average sale price, but strong demand on the buying side combined with low inventory on the listing side is continuing to keep upward pressure on prices.I certainly don’t see interest in Waterloo region as a place to live and work slowing down anytime soon, so we could definitely stand to see some more housing supply hit the market to meet buyer demand. The average days it took to sell a home in August was 28 days, compared to 26 days in August 2017.

If you have any questions or are thinking of buying or selling a property in the coming months, please give me a call at 519-497-4646 or email to kevinbaker@kwhometeam.ca and we can sit down, grab a coffee and discuss the best way to make it a smooth move for your family.

Enjoy your weekend!

Kevin

Home Sales are down but Prices are Up here is Kitchener Waterloo Region

The hot weather is here!! I hope you have been able to stay cool during our recent heat wave. The June stats are out and home sales in June were down but prices are up! Have a read through the stats to hear how the Residential Home market did here in Waterloo Region.

June home sales were down 12.8 per cent compared to last month and down 15.6 per cent compared to last year’s June which was the second highest on record. A total of 604 residential properties sold in June compared to 716 the same time last year. On a year-to-date basis there have been 3,096 home sales during the first half of the year, a decrease of 19.1 per cent. After two consecutive years of extraordinary activity where we saw home sales exceeding 700 units in June, some normality has returned to the market. The approximately 600 units that sold last month is in line with the ten-year average for June.

Residential sales in June included 365 detached (down 21.2 per cent compared to June 2017), and 151 condominium units (up 6.3 per cent) which includes any property regardless of style (i.e. semis, townhomes, apartment, detached etc.). Sales also included 38 semi-detached homes (down 29.6 per cent) and 43 freehold townhouses (down 15.7 per cent).

The average sale price of all residential properties sold in June increased 5.2 per cent to $489,584 compared to the same month a year ago. Detached homes sold for an average price of $575,003 an increase of 7 per cent compared to June of last year. During this same period, the average sale price for an apartment style condominium was $314,180, an increase of 13.2 per cent. Town homes and semis sold for an average of $378,562 (up 10.8 per cent) and $391,830 (up 2.9 per cent) respectively. The median price of all residential properties sold last month was up 5.9 per cent compared to June of last year at $450,000, and the median price of a detached home during the same period increased 9.5 per cent to $520,000. There were 850 residential properties listed in K-W and area last month, down 21.5 per cent compared to June of 2017, but fairly close to the historical (2007-2016) average of 859. The number of active residential listings on the MLS® System to the end of June totaled 1,030, which is 11 per cent higher than June of last year but still significantly below the historical (2007-2016) ten-year average of 1,728 listings for June.

This is a good time to sell as demand remains strong and very competitive within some price ranges. The mortgage stress-test is certainly impacting some buyers which has made some price ranges of homes even more competitive. Of course, this is also a great time to buy in Waterloo Region. I think we’ve been traditionally a little undervalued and even with the past two years of feverish activity, Waterloo Region remains an attractive area to live and homes here will remain a good investment over the long-haul. The average days it took to sell a home were up slightly in June to 22 days, compared to 16 days in June 2017.

If you are thinking of buying or selling please give me a call and we can sit down, grab a coffee and discuss what the best strategy is for you and your family in this current Real estate environment here in Waterloo Region. Feel free to call me at 519-497-4646 or email direct to kevinbaker@kwhometeam.ca

Enjoy your July!!

Kevin

Strong Home Sales in May for Kitchener Waterloo

Summer is here and I hope that you able to get out and enjoy the great weather that we have had the past month.

May was another strong month for home sales in the Waterloo region. Here are the stats for the month of May.

Last month home sales were up 12.5 per cent compared to last month and down 15.3 per cent compared to last year’s record-setting May. A total of 692 residential properties sold in May compared to 817 the same time last year. Although unit sales were down substantially compared to last year’s manic market, May was still a strong month of home buying and selling in Kitchener-Waterloo and area.

The ten-year average number of home sales in Kitchener-Waterloo and area for the month of May is 625. Residential sales in May included 414 detached (down 15.7 per cent compared to May 2017), and 169 condominium units (down 7.1 per cent). Sales also included 46 semi-detached homes (down 28.1 per cent) and 53 freehold townhouses (down 24.3 per cent).

The average sale price of all residential properties sold in May decreased 2.4 per cent to $482,873 compared to the same month a year ago. Detached homes sold for an average price of $572,206 a decrease of 3.4 per cent compared to May of last year. During this same period, the average sale price for an apartment style condominium was $301,052, an increase of 2.7 per cent. Townhomes and semis sold for an average of $365,715 (up 1.3 per cent) and $393,616 (up 2 per cent) respectively. The median price of all residential properties sold last month was down 0.9 per cent compared to May of last year at $445,000, and the median price of a detached home during the same period decreased 2.8 per cent to $520,000.

There were 1,068 residential properties listed in K-W and area last month, down 15.8 per cent compared to May of 2017, but up 14.4 per cent compared to the historical (2007-2016) average. The number of active residential listings at the end of May totaled 1,062, which is 27.9 per cent higher than May of last year but still significantly below the historical (2007-2016) ten-year average of 1,719 listings for May.

With interest rates expected to increase in July, we’re seeing strong demand for homes in Waterloo region. Sales are strongest in the four to five hundred thousand price range, and while we’re certainly seeing activity cool from the past two years, once you eliminate those you quickly realize that sales volume and prices remain ahead of the ten-year averages. The average days it took to sell a home in May was 20 days, compared to 11 days in May 2017.

If you have any questions or are thinking of buying or selling a property in the coming months, please give me a call at 519-497-4646 or email to kevinbaker@kwhometeam.ca and we can grab a coffee and discuss the best way to make it a smooth move for your family.

Have a great June!

Kevin

Seller’s or Buyer’s Market – Depends on the Price Range – Kitchener Waterloo Realestate update

Hope you are enjoying the great weather we have been having in the past week and it looks like summer is just around the corner.

Here are the stats from April and sales have picked up. In April, there was 616 residential properties sold which was up 13.7 per cent compared to last month and down 19.6 per cent compared to home sales a year ago. Home sales in April were as brisk as the temperatures. While down from last year’s record breaking number of sales, it was a slightly more active April than average historically speaking.

Residential sales in April included 343 detached (down 30.7 per cent compared to April 2017), and 185 condominium units (up 12.8 per cent). Sales also included 41 semi-detached homes (down 22.5 per cent) and 46 freehold townhouses (down 13.2 per cent).

The average sale price of all residential properties sold in April decreased 6.6 per cent to $478,578 compared to the same month a year ago. Detached homes sold for an average price of $569,159 a decrease of 4.2 per cent compared to April of last year. During this same period, the average sale price for an apartment style condominium was $296,958, an increase of 10 per cent. Townhomes and semis sold for an average of $386,072 (up 2.5 per cent) and $402,842 (down 3.3 per cent) respectively. The median price of all residential properties sold last month was down 7.4 per cent compared to April of last year at $440,000, and the median price of a detached home during the same period decreased 3.9 per cent to $511,750.

There were 974 residential properties listed in K-W and area last month, down 2.2 per cent compared to April of 2017. The number of active residential listings on the KWAR’s MLS® System to the end of April totaled 993, which is 78.6 per cent more than April of last year but still significantly below the historical (2007-2016) ten-year average of 1,637 listings for April. When you look closer at how the forces of supply and demand were at work last month, it becomes really clear that the question of it being a buyer’s or seller’s market really depends on which price range you’re in. Last month 71 per cent of all residential sales were for less than half a million dollars, but the number of homes listed in that price range right now is a little less than half of all the inventory. I believe the new stress test introduced earlier this year is fueling demand for lower priced homes and making it more difficult for prospective move-up buyers to get financing. The average days it took to sell a home in April was 21 days, compared to 11 days in April 2017.

If you have any questions or are thinking of buying or selling a home or condo in the coming months, give me a call at 519-497-4646 or email to kevinbaker@kwhometeam.ca and we can sit down for a coffee and discuss the best strategy for your family.

Have a great May!

Kevin

Kitchener Waterloo Real Estate Update for February 2018

Hope you are enjoying the great weather we have been having in the past few weeks. Spring is just around the corner and I can’t wait to get out there and enjoy the warm weather again.

Here are the stats on how the Kitchener Waterloo market did in the month of February. There were 377 residential properties sold through MLS® in February which was an increase of 40 per cent compared to last month and a decrease of 20.5 per cent compared to home sales a year ago. When we consider market activity we have to acknowledge that sales from the previous year or two were abnormally high. If you compare last February against the ten year average of sales, it was a pretty typical February.

Residential sales in February included 212 detached (down 29.3 per cent), and 118 condominium units (up 11.3 per cent) which includes any property regardless of style (i.e. semis, townhomes, apartment, detached etc.). Sales also included 25 semi-detached homes (down 21.9 per cent) and 17 freehold townhouses (down 45.2 per cent).

The average sale price of all residential properties sold in February increased 3.1 per cent to $478,801 compared to February 2017. Detached homes sold for an average price of $577,609 an increase of 5 per cent compared to February of last year. During this same period, the average sale price for an apartment style condominium was $265,144 for an increase of 6.8 per cent. Townhomes and semis sold for an average of $386,515 (up 14.1 per cent) and $391,628 (up 6 per cent) respectively. The median price of all residential properties sold last month was practically on par with February of last year at $436,143, and the median price of a detached home during the same period increased 4.8 per cent to $524,000.

The market has certainly cooled from this time last year, which is to be expected with the government’s efforts to make home ownership more difficult for home buyers. Realtors listed 551 residential properties in K-W and area last month, an increase of 0.5 per cent compared to February of 2017. The number of active residential listings on the MLS® System to the end of February totaled 667, which is 61.5 per cent more than February of last year, but still significantly below the previous ten year average of 1445 listings for February.

Months of inventory continues to track at a low 2 months. The average days it took to sell a home in February was 22 days, compared to 18 days in February 2017. We still have some homes that are selling in short order and with multiple offers, but others are taking longer and multiple offers are no longer the rule. Sellers need to adjust their expectation in this evolving market and in order to sell quickly they must be priced and marketed appropriately. While listing inventory is increasing, this is a slow process and we expect home inventory to remain low for at least the remainder of the year.

If you are thinking of buying or selling a home this year its important to have a solid strategy moving forward. Give me a call and we can grab a coffee and sit down and discuss the best options for you and your families needs.

Have a great March!

Kevin

A Big Year For Kitchener Waterloo Home Sales in 2017

Happy New Year!

It was a Huge year for Home Sales in 2017 here in Kitchener Waterloo with total residential sales volume surpasses 3 billion. There were 6,549 homes sold in Kitchener-Waterloo and area last year through the Multiple Listing System (MLS® System), just one percent behind last year’s record smashing results.

The year ended strong with 301 home sales in December, which is a slight one per cent above December of 2016, and 13 per cent above the previous five year average.

There was a definite push by some buyers to purchase a home prior to the new mortgage stress test kicking in January of 2018. While we appreciate the intent of these additional

changes, ultimately they will make it harder for some consumers to purchase the home they want. Picking up on the momentum from 2016, the first half of 2017 was characterized by an unparalleled number of home sales. Then in the latter half of the year, on the heels of the Ontario government’s announcement of the Fair

Housing Plan, the pace of sales began to decrease while still remaining above the previous five year’s averages.

There is almost universal agreement that the introduction of the Ontario Fair Housing Plan, which included a tax on non-residents who purchase homes in the Greater Golden Horseshoe (GGH) did contribute to the decline in home sales in the last half of the year, however that was mostly due to the psychological impact it had on buyers and sellers in the marketplace. For Waterloo Region these impacts were not yet as acute as in other areas of the GGH, but we are certainly concerned that any additional restrictions will further impede consumer affordability for homes.

Total residential sales in 2017 included 4,005 detached (down 4.2 per cent), and 1,461 condominium units (down 2.9 per cent) which includes any property regardless of style (i.e. semis, townhomes, apartment, detached etc.). Sales also included 545 semi-detached homes (up 27.6 per cent) and 467 freehold townhouses (up 10.9 per cent).

The consumer demand we experienced in 2017 was certainly strong enough to have outnumbered 2016 home sales, however the continued tight supply of listings last year served to tamp down unit sales and drive up prices. While the number of homes that were put up for sale was in keeping with previous years, inventory tracked low all

year long as buyers continued to snap up properties at a terrific rate. The average days it took to sell a home in 2017 was 19 days, compared to 43 days if you were to average out the previous 10 years.

Dollar volume of all residential real estate sold last year increased 19.5 per cent to just over three billion ($3,061,739,723) compared with 2016, reflecting the strong price gains realized in 2017 and marking the first time sales have surpassed the three billion dollar milestone. The average sale price of all residential properties sold in 2017 increased 20.7 per cent to $467,513 compared to 2016. Detached homes sold for an average price of $549,046, an increase of 21.5 per cent compared to 2016. During this same period, the average sale price for an apartment style condominium was $271,940 for an increase of 18.3 per cent. Townhomes and semis sold for an average of $353,692 (up 23.6 per cent) and $378,275 (up 25.9 per cent) respectively.

The median price of all residential properties sold last year increased 21.1 per cent to $429,900, and the median price of a detached home during the same period increased 22 per cent to $495,000. With the continued influence of GTA buyers migrating to Waterloo region last year, 2017 was a great year if you were selling your home, but not so fun for those who were in the purchasing position. The quality of life enjoyed living in Waterloo Region has always been at the top compared to many other communities, even though our historical home prices have been relatively affordable. I think this secret is out now, and the activity of buyers from the GTA last year certainly demonstrates this.

While the frenzied buying activity has cooled under the multitude of newly-imposed government regulations, looking ahead we expect the demand to continue to be greater than the supply. While the balance is shifting, we do not believe there will be any decreases in property values and if anything, the correction for Waterloo Region was watching it increase. Of course, this will continue to put pressure on affordability for many would-be homebuyers.

The new stress test that just came into effect on January 1 is going to push some buyers out of the market and force others to purchase homes at a lower price point than they want as it reduces their ability to borrow.

If you have any questions on our local real estate market or if you are thinking of buying or selling a home or condo in 2018 please don’t hesitate to give me a call at 519-497-4646 or email to kevinbakerrealestate@gmail.com We can grab a coffee and discuss how I can help.

Have a fantastic 2018!

Kevin

Solid Home Sales for Waterloo Region in September

Happy Thanksgiving to you and your family. I hope you are able to spend some time together during this festive season and wonderful weather.

I wanted to give you a quick update on the Waterloo Region housing market so here are some latest stats and thoughts. A total of 470 residential properties changed hands in September. This was a decrease of 12.8 percent compared to the record number of sales in September of 2016, but still ahead of the previous 5-year September average of 437 sales.

On a year-to-date basis 5,357 residential units have sold compared to 5,239 during the same period in 2016, an increase of 2.3 per cent. We are seeing strong demand continue into the autumn. Residential listing inventory to the end of September totalled 843, which is ahead of September of last year, but represents just half the number of listings that were on the market in the previous five years (2011-2015) for September.

September’s sales included 285 detached homes (down 14.2 per cent), and 105 condominium units (down 19.2 per cent). Sales also included 38 semi-detached homes (up 22.6 per cent) and 37 freehold townhouses (up 12.1 per cent).

The average price of all residential properties sold last month increased 12 per cent to $455,079 compared to September 2016. The average sale price for an apartment style condominium was $261,337 for an increase of 6 per cent. Townhomes and semis sold for an average of $359,448 (up 20.9 per cent) and $372,226 (up 19 per cent) respectively. Detached homes sold for an average price of $513,873 in September for an increase of 10 per cent compared to a year ago. Our local residential real estate market continues to show solid price growth and unit sales even though year-over-year price appreciation peaked in April of this year when the average price of a detached home increased 40 percent to $594,108. Today, on a year-to-date basis, the price of a detached home has averaged $553,029, an increase of 24.7 percent compared to 2016.

Last month 32% of all residential transactions were in the $300-399,999 range; compared to just 15.6% in April. We also saw more transactions in the higher price ranges during the heat of the spring market. There were 20 sales that occurred over the one million dollar mark in April, compared to only 5 in September. The average days on market in September was 36, compared to 57 days a year ago. On a month to month basis, it took ten additional days on average from list to sale date in September compared to August. The feverish spring conditions have given way to a saner playing field, however an increase in listings would be a welcome shift for homebuyers who would benefit from increased selection across the more affordable price ranges.

If you have any questions or would like to sit down and discuss buying or selling a property please give me a call and we can work out a plan that best works for your families needs.

Happy Thanksgiving!

Kevin

No Signs of Cooling the Hot Kitchener Waterloo Real Estate Market

The trend continues here in Kitchener Waterloo with no signs of cooling. The demand for homes is Hot Hot Hot.

A total of 540 residential properties changed hands in Kitchener Waterloo and area though the MLS® System. This represents a 29.2 percent increase in sales compared to September of 2015, and is a new record high for the month.

On a year-to-date basis 5,241 residential units have sold compared to 4,456 during the same period in 2015, an increase of 17.6 percent. This is the first time sales have exceed the 5000 unit mark at the end of the third quarter. The demand is strong but the supply of homes still continues to lag well behind. Residential listing inventory totaled 815, a decline of 51 percent compared to September 2015.

Showing the most traction, were the sales of condominium type units, which include any property regardless of style (i.e. semis, town homes, apartment, detached etc.), increasing 80.6 percent to 130 transactions in September relative to the same month a year ago.

Meanwhile, 333 single detached homes sold last month, an increase of 19.8 percent, compared to last year. September’s sales also included 31 Semi-detached homes (down 18.4 percent) and 33 freehold townhouses (up 22.2 percent).

The average price of all residential properties sold year-to-date was $380,692, a 9.7 percent increase over 2015. The average price of a detached home to the end of the third quarter was $443,554, an 11.8 percent increase over 2015. During this same period, the average sale price for an apartment style condominium was $231,187, an increase of 4.5 percent. Townhomes and semis sold for an average of $281,709 (up 8.3 percent) and $293,167 (up 8.5 percent) respectively.

The median price of all residential properties sold year-to-date increased 9.9 percent to $350,000, and the median price of a detached home during the same period increased 10.9 percent to $400,500. Like many other markets in Ontario, it continues to be a sellers’ market here in Waterloo region. Due to the outweighing demand over supply, its putting upward pressure on prices.

With the new changes by the federal government, introducing the mortgage rate “stress test” on all new insured mortgages, could delay home purchases for some first time home buyers, as they assess what they can afford, and possibly save for a bigger down payment.

I don’t believe that these changes will impact our area to a large degree, the very fact that the government is taking steps could cause a slight cooling of the market.

If you have any questions or are thinking of buying or selling this fall please give me a call and we can discuss some strategies that would work best for you.

Have a great Thanksgiving!

Kevin